Payroll accounting

Payroll accounting

Apart from the correct calculation of wages, the payroll accountant´s agenda includes payroll and related legal advice. A majority of our clients are curious about when they can “employ” a self-employed person instead of a salaried employee, how maternity allowance is calculated, or how to set up an employee stock ownership plan (ESOP). We therefore provide our clients with:

- comprehensive payroll management;

- tax-contribution and pandemic consulting;

- advice on setting up employee stock option plans (ESOPs);

- advice on the use of the "self-employed" as a workforce in lieu of salaried employees.

We believe every client appreciates when their employees don’t complain about an incorrect or late paycheck. We aim to be your reliable and responsible partner. We adapt our internal structures accordingly. We want and need to be malleable, which is why we have a double layer of flexibility.

In our opinion, managing payroll for outsourcing clients is subject to three fundamental challenges:

- emphasis on automation;

- contribution and pandemic consulting; and

- its link with employment and tax law.

Emphasis on automation

We strive to communicate with our clients and procedurally set up the transmission of attendance and salary information so that it is automatically fed into the accounting software. We want clients to have access to this information and be able to view their current employee details online (e.g.: unused vacation, reserves, flexible working hours, etc.). The correct setup of data transfer with the client minimizes human error on both ends.

Our clients deserve more than just correct payroll calculations – this can be handled by any payroll software. They are interested in added value:

- calculation of maternity allowance for their employees/ contractors;

- simulating the impact of school closures;

- attendance allowance; or

- the abolition of the maximum assessment base for social insurance.

The first wave of the pandemic demonstrated the effectiveness of active payroll management. In the first few weeks, several clients suffered from plummeting incomes, non-payment of invoices, and lower volume of work. The State struggled to respond, creating a patchwork of complex tax-contribution-pandemic measures which required active management.

And that´s where we come in.

Payroll issues cannot be addressed comprehensively without legal advice – which is why our accounting clients naturally also receive advice on labor law matters. As many employers learnt during the first COVID-19 wave, the Labor Code, coupled with contribution obligations, can let an employer down. Thus, we are confident our clients appreciate having payroll accounting and practical legal advice under one roof.

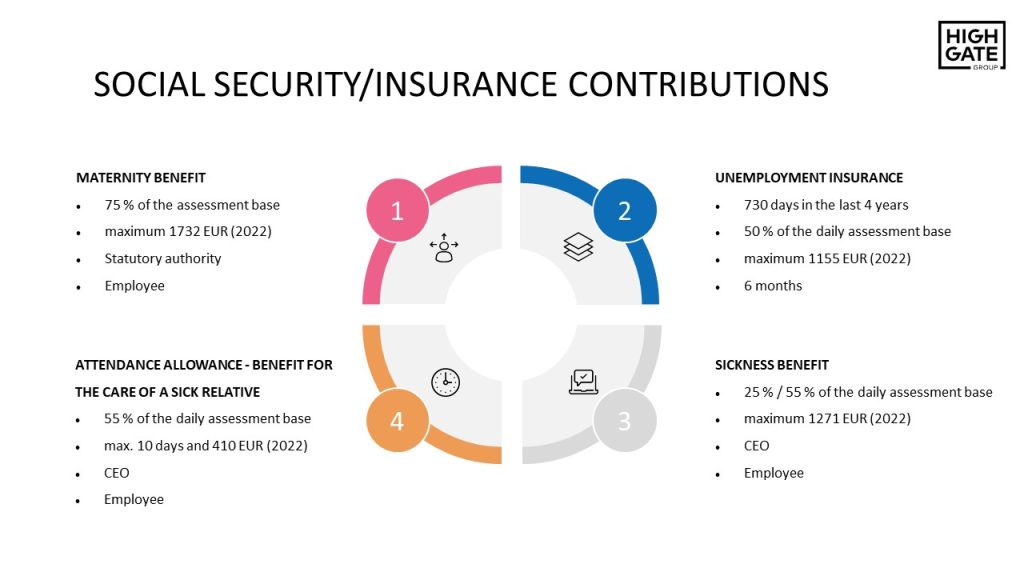

Contribution and pandemic consulting focus on tax or contribution optimization, advice on social insurance benefits, and pandemic relief. Clients are mainly interested in the setup of:

- maternity allowance;

- attendance allowance;

- unemployment benefit;

- pension;

- sickness benefit;

and the relationships between the different types of benefits and their combination with pandemic relief.

Payroll consultancy is more than just correct wage calculation, payment orders issuance, and reporting to public authorities. It is also about providing our clients with comfort in their individual queries. The topic of maternity benefit is popular among smaller companies, their owners, employees, and “contractors” in their search for answers.

Maternity compensation is determined by several factors. These are the legal form of an individual´s economic activity, the assessment base, and the length of employment. The maternity allowance increases annually, its maximum amount gradually approaching 2 000 EUR/month (31-day month). Maternity pay is therefore a relevant source of income for employees, contractors, and our clients themselves.

In addition to maternity benefits, clients are often interested in other forms of state support in various life situations, including unemployment benefits, attendance allowances, sickness benefits, or different forms of pension. In the times of pandemics, individual benefits have their derivatives, something very difficult for clients to understand. Included in our consultations is advice on the legal and effective use of these institutions.

The pandemic exposed the potential for legal order complexity in all its glory.

Various pandemic exceptions, derivatives, and new institutes were added. The pandemic and its dynamic political environment threw the legal order into a state of constant flux.

It´s become difficult for clients to follow.

Our role in such a climate is to monitor, on behalf of our clients, the current developments and advise them on their individual queries.

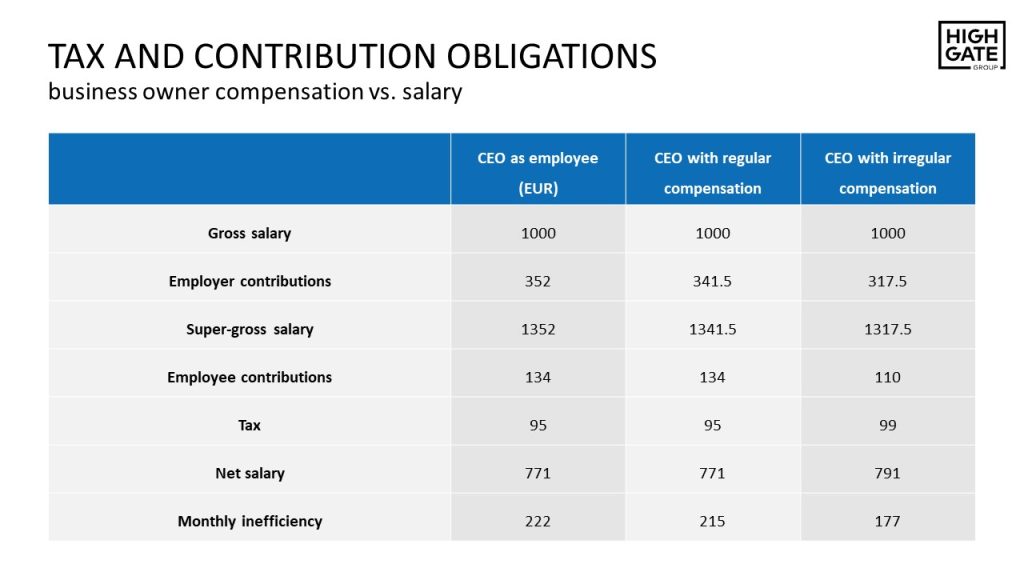

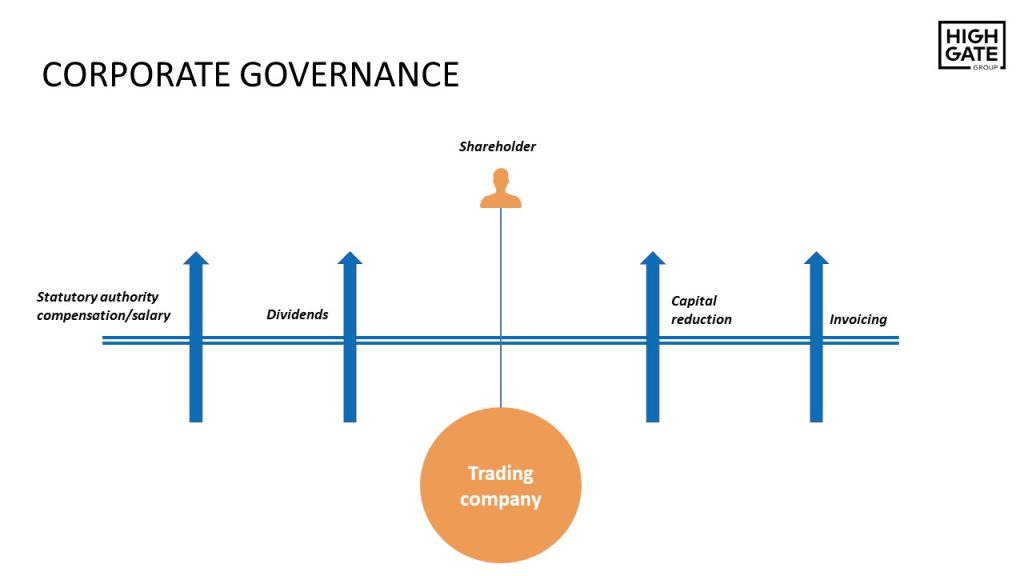

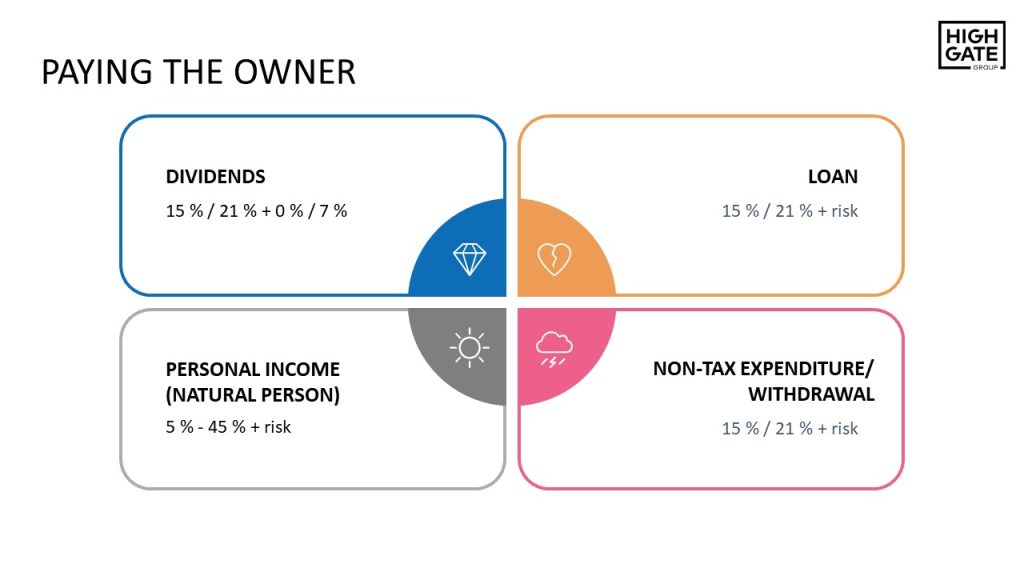

How entrepreneurs can get paid through the company

Included in our operational accounting services is advice on tax-efficient and legally defensible forms of getting paid through the company. Is it better to pay yourself via salary or a director´s fee? What are the implications for social insurance benefits and minimum contributions? Is invoicing one´s own company defensible? There are options, and we tailor them to the needs of the individual, taking into consideration the unique circumstances and firm´s capabilities.

When doing business through trading companies, it is essential to understand that a company is a separate legal entity, strictly separated from the natural person who owns it.

If this were not the case, the owner of a limited company (e.g., joint stock company or LLC) would not be able to enjoy the benefits of his company´s limited liability over debts and obligations. It would be fishy to not be liable for the company´s obligations while at the same time using the company’s assets (including funds) for private purposes.

Such a separation is also crucial for tax and accounting purposes. There are cases where the tax authorities have reclassified withdrawals by the owner as employment or other income.

Both are unfavorable from a tax-contribution standpoint. In certain circumstances, arbitrarily transferring funds from a business to the owner may be classified as a tax and/or criminal offence.

Learn more on this topic in Peter Varga´s article Business funds for private purposes: Examples and most common mistakes.

Small entrepreneurs, especially, like to withdraw money for private consumption from the company account. This increases the “petty cash balance” in accounting.

It is common for smaller companies not to extract company profits. They are discouraged by the dividend tax, and motivated by the belief that with small figures, they won´t attract the tax authorities´ attention.

It is also uncommon for smaller company owners to pay themselves a market ratw salary/an owners draw due to the high tax burden.

In addition to the use of corporate property for private purposes, the entrepreneur often compensates herself in various other, non-standard ways.

This results in a high petty cash balance or shareholders receivables balance. On the liabilities end, this gives rise to a “dividend capacity”. If the company runs into financial difficulties, it may have the following consequences for the business owner:

- Personal liability for owners in cases of discrepancy between petty cash and the actual balance;

- an owner´s obligation to repay the company in full, with a risk of personal liability to fulfil this obligation;

- the owner's liability for the bankruptcy of the company (including the payment of dividends), risking personal liability; or

- the illegality of extracting profits from the company;

- tax imposition (other income/employment income or dividend);

- tax evasion and insurance fraud;

- economic offence (e.g. creditor claims, embezzlement, etc.).

We tailor plans for clients to get paid through the company, considering the accounting, tax, and legal aspects. The Commercial Code tightly restricts a company’s ability to pay the owner through the company. The COVID-19 pandemic demonstrated the unpredictability of economic impacts, and that companies are required to act preemptively.

A selection of services we offer in this area:

- analysis of legally defensible options to get paid through the company;

- tax optimization related to getting paid through the company (Tax optimization - Domestic and Foreign Options);

- representation in tax proceedings;

- preparing relevant legal documentation and adding transparency to the existing state of owner compensation.

Each of these options has different tax implications. It is important to distinguish whether the remuneration is paid to a legal entity or an individual, and in which country the influencer in question is established. We provide our clients with all the necessary support in this area.

Even during the pandemic, we received a great deal of inquiries about the possibility of moving abroad temporarily or permanently. There are various reasons – from more favorable cryptocurrency taxation to nontax reasons for digital nomads. Travelling involves various tax implications

Accounting digitalization & automation consulting services

In accounting automation and digitalization, we are our clients´ advisor and tester in setting up their internal processes. Such cooperation simplifies everyone´s administrative life. Setting up automation elements at a client’s onboarding stage had initially been just a secondary activity. Nowadays, it is becoming a stand-alone consulting service. Accounting digitization and automation are here and progressing. We create added value for our clients via consultation and advice, not manual accounting.

Accounting digitalization

Digitalization consists of archiving and automation. It aims to replace paper documents with structured digital reporting (data) that accounting entities can archive digitally and circulate via email, online document sharing, or EDI (Electronic Data Interchange).

Accounting automation

Automation streamlines internal and external processes in accounting and data transfer. It replaces routine manual activities such as transcription of data from invoices into accounting software or handing printed documents over to the accountant (document cycle, including archiving).

Top 5 benefits of digitalization:

- Saves administration, archiving, printing, stationery, and electricity costs (more environmentally friendly)

- Physical presence of an accountant in the office is no longer necessary

- Faster data/accounting documents transfer from the client to the accountant and vice versa

- 24/7 access to the document archive in the online interface – no more basements and cupboards stuffed with binders and folders

- Easy retrieval of documents from the electronic archive

Top 5 benefits of automation:

- Automatic data extraction from documents without lengthy transcription (reducing human errors)

- Automated tools process a larger data volume in less time, no rest needed

- Reduction of printing, delivery, archiving, and labor costs

- Saved time translates into added value in terms of advice and complexity of accounting cases that AI cannot provide.

- Automated cash flow processes save human labor costs associated with sending reminders and collection calls to pay invoices.

Preceding the actual digitization should be the study of relevant legislative requirements. The following deserve special attention:

Especially relevant when digitizing payroll accounting, HR, and employment contracts

Accounting record retention, archiving, transformation, and verifiability. The definition of “accounting record”.

Retention of invoices; invoice & its content

- Act No 395/2002 Coll. on Archives and Registries and on the Amendments of Certain Acts

- 305/2013 Coll. on the Electronic Form of Governance Conducted by Public Authorities and on amendments and supplements to other acts (e-Government Act)

Conversion and guaranteed conversion, guaranteed conversion procedure, certification statement, limitation of conversion.

An accounting entity can decide (within the limits of its internal guidelines) between electronic (digital), paper-based, or combined bookkeeping. The amendment introduces the equivalence of paper-based and electronic accounting records, subject to the following criteria:

The paper-based accounting record:

- The accounting record must be paper-based or printed using software, sent/transmitted, or received as a hardcopy

Electronic accounting record:

- The accounting record must be generated/issued and received in an electronic format (as determined by the issuer or by agreement with the recipient) and sent electronically (directly from software) or via electronic mail (e-mail)

The following rules apply to both:

- The authenticity of the origin (assurance of the identity of the supplier or the issuer of the invoice, e.g., on the basis of a written purchase order, acceptance of the accounting record by recipient by the act of paying for it)

- Integrity of the content (record must be processed or scanned so that no alteration occurs when the record is transformed, transferred, and disclosed-made accessible)

- Legibility (human readability must be ensured)

The accounting entity is obliged to ensure these requirements are met at all times – from the moment the accounting record is created, during its transformation, receipt, transfer, and disclosure, until the end of its retention period.

The accounting record authenticity and integrity (verifiability) must be ensured pursuant to §32 by means of:

- Signature of the responsible person (handwritten signature, qualified electronic signature, similar verifiable record - code, cipher, or special character)

- Electronic data interchange

- Internal control systems

The responsibility of ensuring the integrity of the record so that it cannot be altered and misused rests with the accounting entity. An internal directive (or guidelines) should define security measures for accounting records.

The most important section in the digitization of accounting records is §33 of the Accounting Act, dealing with the transformation of the accounting record. It remains to be seen how the accountants will cope with the digitalization of documents (the majority of accounting software is partly digitization-ready) and whether they will be able to change their habits (old habits die hard) and adapt to the online trend, which is -to some extent- offered by the amendment discussed.

Accounting record transformation essentials

- Transformation means changing the form of the accounting record (whether from paper to electronic form or vice versa) while the integrity of the accounting record remains intact

- Transformation may be performed only if the accounting record is verifiable.

- Transformation from paper to electronic form may be performed:

- By guaranteed conversion in accordance with specific regulations

- By scanning into a file format in raster graphic form (i.e., an image saved in .pdf, .png, .jpg, .tiff formats), preserving the completeness of the accounting record, its content and visual consistency, the legibility of the entire accounting record, and the integrity of the content.

- Transformation from electronic form to paper may be performed:

- By guaranteed conversion in accordance with specific regulations

- By using a computer output device which allows printing on paper, while preserving the completeness of the accounting record, its content and visual consistency, the legibility of the entire accounting record, and the integrity of the content.

And now… BINGO!!! Is it necessary to retain the original cash receipt from, say, a small purchase of up to 1700 EUR? The amendment states that: “In the case of an accounting record, the form of which results from the transformation, and which is considered verifiable, the provision of the accounting record in its original form shall not be required, unless otherwise specified.”

7 tips for an accounting entity that decides for accounting and archiving digitalization.

- Determine how to store the accounting records (appropriate accounting software), i.e., electronically, so as to make the electronic accounting records accessible (to the auditor, tax authority, or publicly available).

- The accounting records must be retained for 10 years following the year in which they were last used (choose a safe and secure repository that is backed up frequently).

- When exchanging electronic invoices, the parties must sign a written agreement on electronic invoicing.

- When circulating electronic documents, a safeguard mechanism must be in place to ensure that the contents of the accounting record are not misused or altered. At the same time, electronic documents must contain the signature of an authorized person.

- When transforming from electronic form to paper, the transformation may only be performed for electronic documents that do not contain a qualified electronic signature or a qualified electronic seal.

- Transformation of an accounting record from paper to electronic form by scanning may be performed only once (provided it is legible and complete). The transformation cannot be performed if the paper-based record has already been subject to transformation.

- There´s an important parameter to digitalization, that ensures the four most important factors:

1. electronic document approval process

2. electronic document archiving

3. electronic document transmission and protection

4. and (OCR – Object Character Recognition) electronic document extraction.

When switching over to electronic accounting, is it possible to also transform the previous years´ records to electronic form?

The amendment to the Accounting Act has it covered, and states that the relevant provision on the retention of accounting records, as amended in 2022, may also be used for the retention and protection of accounting records produced prior to 2022, provided that the other relevant provisions of the Act are complied with.

An entity may transform all accounting records from previous years, provided that the requirements are met:

- accounting records´ authenticity of origin

- the integrity of their content

- legibility

- and verifiability.

We at Highgate Group are on top of digitalization. We are ready to make our clients’ work with the handover and archiving of documents easier. The well-balanced cocktail of automation, archiving, and digitalization ultimately saves clients time and money which can be reinvested in the development of their business. The process automation means extra time for individual accounting, economic, or tax optimization consultations.

E-commerce & Tech company accounting

We aim to provide “paperless” accounting and automation and emphasize consulting. Therefore, we are inspired when clients have a sense of technological development and streamlining of administrative processes. Our cooperation in setting up their company processes is then more efficient. Ultimately, it shows to the client the true purpose of accounting (i.e., the company overview, transparency of an investor/partner entry, cash-flow analysis, etc.).

We also focus on e-commerce companies and platforms. We work with many Slovak e-shops where we try to set up their accounting in a way that supports the elimination of human inputs, thus reducing costs and improving the overall feeling of accounting.

Is your accounting done efficiently? Answers to these 5 fundamental questions indicate whether your e-shop’s accounting is set up efficiently:

- Do you issue invoices manually?

- Does your accountant post received invoices manually?

- Does your accountant post issued invoices manually to the accounting software?

- Does your accountant post payment gateway transactions manually to the accounting software?

- Does your accountant post credit notes manually to the accounting software?

If you answered “yes” to at least two questions, your e-shop´s accounting system is not set up efficiently.

Issuing paper invoices is a relic of the past. Apart from ecological and economic reasons (toner, printer, and paper costs), paper invoicing makes e-commerce accounting significantly more expensive. The reason is that such accounting requires an accountant´s manual inputs, increasing labor costs dramatically.

An electronic invoice (e.g., in .pdf format) is sufficient for proper posting and audit of a given transaction. Although tax offices sometimes require the paper form, it is always possible to print out documents only to the extent required by the tax authorities. The storage, especially for larger e-shops, of so many issued invoices would be a significant logistical hurdle.

With increasing volume of documents the demand for efficient integration of e-shops with invoicing or accounting systems also increases. Linking the e-shop (WooCommerce, Opencart, PrestaShop, Shoptet and others) with the invoicing or accounting system (e.g. SuperFaktúra) or accounting software (Pohoda, Omega and others) via API or connector is a must. It reduces the cost of accounting and aids business transparency.

There is no further need for manual inputs, and the entrepreneur can only cross-check occasionally. Invoices are issued automatically, either in the accounting or invoicing software, or directly in the e-shop. They are fed into the accounting software with the help of a connector or API.

Even if the invoices, credit notes, or advance invoices (proforma invoices) are generated automatically in the system, there is difficulty importing these into the accounting system. Manual import is inefficient. There is a myriad of tools eliminating manual inputs. It is essential to set up the correct accounting software data structure so that the information contained in invoices and other documents is automatically fed into the accounting software.

If done correctly, clients don’t pay for labor. Instead, they pay a small fee for automation and pairing and subsequent review by the accountant.

The payment gateway/bank account agenda is broad in e-commerce. Choosing the right payment gateway and bank account can save you a considerable sum. In payment gateway accounting, every payment sent or received must be recorded in the bank account / ledger (journal). If an e-shop issues 500 invoices per month, and receives 500 payments, this is an incredibly high volume per each payment gateway for an accountant to record manually.

In Slovakia, the most popular payment gateways are GoPay, Stripe, PayPal, ComGate, Revolut. Standard bank transfers are often used. With payment gateways, the initial setup is important. So too is the correct structure for importing into the accounting software, with automatic matching to issued invoices and credit notes. Start-up e-shops can handle this agenda manually. However, should the entrepreneur have higher ambitions, proper setup of payment gateway imports is imperative.

The amendment to the VAT Act of 01.07.2021 harmonized the rules of all EU member states regarding the distance sales of goods (e-shop) and the supply of electronic services (services related to the original MOSS scheme). When a taxable subject (trading company or a natural person) exceeds an aggregate turnover of 10 000 € on supplies of TBE (telecommunications, broadcasting, and electronic) services and distance sales of goods within the EU, it must:

- register for an OSS scheme, or

- register in each Member State in which goods or services are supplied to customers.

We help clients with both.

Contemporary e-commerce is closely linked to influencer marketing (the use of influencers who advertise/sell e-shop products and services). Great care in terms of tax risks must be taken when remunerating influencers. If the e-shop incorrectly withholds tax or fails to prove to the tax authority that it did not have to withhold the tax, the tax authority may impose a tax of up to 35% of the amount paid to the influencer + penalties, which may amount to up to 100% of the imposed tax.

Influencers generally provide the following services:

- product placement in posts;

- lending face for advertising purposes;

- „merchandise“;

- event appearances or "posing" with products; or

- sponsorship agreements.

Each of these has different tax implications. It is important to distinguish whether the remuneration is paid to a legal or a natural person, and in which country the influencer in question is established. We provide essential support on this complex topic.

E-shops, like any other company, can use legal tax and contribution optimization methods (Tax Optimization: Domestic and Foreign Options). In addition to the standard tools, e-shops have (due to their nature) wider options for more efficient taxation.

Our accounting clients enjoy such additional advisory services. These are offered either as expert consultations with Peter Varga, or on a comprehensive basis where we analyze the client’s business in more detail and propose tailor-made solutions.

We are happy to provide our accounting clients with comprehensive compliance documents for e-shop management (e.g.: GDPR, general T&Cs, privacy policy, etc.).

Our law firm, Highgate Group, specializes in tax disputes (Tax audits and representation in tax proceedings). We represent clients in tax audits and in subsequent court proceedings. Should such a situation arise, our clients have someone to turn to and, thanks to Highgate Group, can save on the cost of legal representation.

In addition to expert consultations, our accounting clients are invited to use a range of legal document templates (e.g.: loan agreement, employment contract, cooperation agreement, notice of termination, general meeting resolution, etc.), prepared by Highgate Group. They also have access to relevant business information:

- Is it better to buy an apartment as a natural or a legal person?

- What are the more efficient cryptocurrency taxation options?

- E-shop – use our training to watch out for VAT changes.

SME accounting

Accounting is often perceived as an unavoidable administrative burden. Our aim is to change this via a “paperless” approach, automation, imports, and tax consulting. We also want to revive accounting´s practical-economic sense (i.e., the company overview, transparency of an investor/partner entry, cash-flow analysis, etc.). Our accounting clients are also offered:

- access to a range of legal document templates (e.g.: loan agreements, employment contracts, cooperation agreements, notice of termination, general meeting resolutions, etc.), prepared by the Highgate Law & Tax firm;

- free or discounted access to relevant legal and tax information for businesses through our training courses and conferences;

- 50% discount on personal consultations with Peter Varga;

- an opportunity to use an invoicing system and document storage, integrable with accounting software;

- technical consultations on online access to accounting, automatic document import into accounting system via connector, integration of accounting software with CRM, accounting apps advice, and stock management setup;

- tax optimization - efficient business setup with respect to taxes and contributions, advice on business owner compensation

- representation in eventual tax disputes.

We provide accounting services for smaller companies. Our clients range from “single- member LLCs” to medium-sized companies with up to 100 employees. Our goal is reciprocal process efficiency, digitalization, and elimination of manual inputs, so we are thrilled to work for clients who are flexible in setting up their accounting processes.

How do small businesses benefit from working with us?

Our tax and legal advice is attractive, especially to small businesses and “single-member LLCs”. Every business owner is interested in:

- legal ways to reduce tax and contribution obligations;

- understanding the risks of using company assets for private purposes;

- how to get the maximum maternity allowance;

- whether it is really necessary (and to what extent) to deal with transfer pricing in every Related Party Transaction;

- whether it is better to buy real estate/cryptocurrency/securities as a natural or a legal person;

- whether it is possible/necessary to have a minimum full-time employment in one´s own company; or

- what are the options for getting paid through your company (legal and tax implications).

- The client wishes to have an overview of financial flows; manage a certain agenda in the accounting system (e.g. received invoices, or e-shop stock management);

- The client is not interested in participating in the accounting to any greater extent than just uploading documents (to the storage in the account provided by Highgate Group);

- The client prefers to manage the entire accounting process in the accounting software, and only requires Highgate Group to check/audit and correct the posting of accounting records;

- We strive to keep pace with the age of digitalization, fast data transfers and automation of individual processes (accounting, tax, or legal). We aim to provide superior and personalized accounting services. We adapt to clients´ needs and personalize their accounting setup in several areas:

Each client receives a unique online account that allows them:

- to issue invoices in line with relevant legislation, with automatic retrieval of partner details from the Commercial Register;

- tracking of issued invoice payments, automatic matching;

- uploading of documents to a personal data storage;

- automatic outstanding invoice reminders;

- periodic invoices with automatic sending to customers;

- batch invoice payment, xml file export;

- price list making;

- driver logbook register;

- company economic indicators overview;

- online cash register management;

- other interesting functionalities.

Online accounting and its automation also affect e-shops and the automation setup itself in posting issued invoices, payment gateways (GoPay, PayPal, Adyen, Stripe etc.), bank account activity, or the use of CRM systems and apps. In e-commerce (Accounting for e-shops), it is crucial that the various inputs and outputs are efficiently linked.

Successful implementation of these technical and process-related elements significantly reduces accounting costs.

Double-entry bookkeeping

Every company or cooperative (LLC., joint stock company, etc.) is legally obliged to use double-entry bookkeeping. Almost every country in the world, save for some tax havens (Tax Optimization & Offshore companies), has developed its own, unique system of financial accounting regulation, which governs the way in which businesses record their economic activity. Double-entry bookkeeping constitutes the core group within accounting.

Given the different historical developments, there are no uniform rules for modern double-entry bookkeeping. This creates a natural space for the creation and dissemination of international accounting standards such as IFRS. However, these are not yet being used by SMEs which still need a local accountant in Europe to do their accounting.

Double-entry bookkeeping is formalized, giving the accounting its structure. It must stem from legislation aiming to harmonize its method and form among different accounting units. The aim, above all, is to obtain a reliable and transparent picture of the business- i.e., so that the State can monitor the correct tax collection or allow an investor to assess the company´s economic performance.

Correct and transparent double-entry bookkeeping increases a company´s value upon investor entry or company sale. It also increases credibility in bank financing. Naturally, these advantages won´t be appreciated by a small business owner who uses a trading company only for tax-contribution reasons or limited liability.

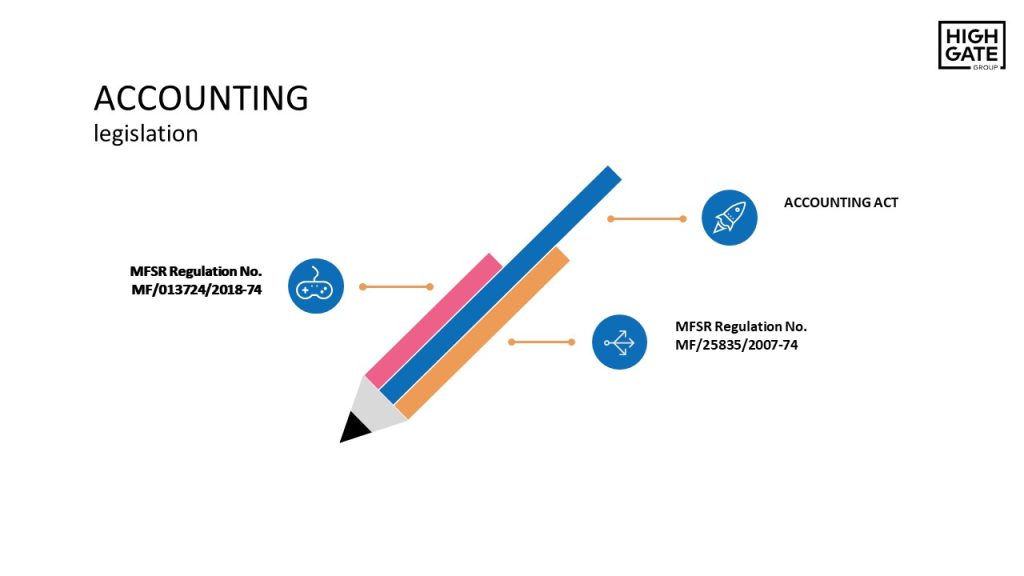

It is precisely for the sake of uniformity and accuracy in accounting that we have adopted economic laws and statutory measures that have shaped the bookkeeping process. In Slovakia, the most important of these is the Accounting Act and the latest accounting procedures. Other legislation follows, such as the Commercial Code or the Income Tax Act, which transform the content of accounting into a more familiar area for the public, such as the payment of taxes.

In general, every Slovak business entity that is also a legal entity is obliged to use the double-entry accounting system. This is a complication for small business owners who do not enjoy much complexity in accounting. Unfortunately, due to different historical accounting developments, there are no uniform, international rules for accounting today, and therefore the Slovak double-entry bookkeeping cannot be used outside Slovakia. This also means that a Slovak accountant (cheaper labor) can hardly follow German accounting rules.

Nonetheless, double-entry bookkeeping does not have to be used by entrepreneurs who are natural persons. They can opt for single-entry accounting, tax records, or apply flat-rate expenses.

Companies established in tax havens do not have to use double-entry bookkeeping either. On the other hand, with the increasing demand for transparency, there is a requirement for these companies to do at least some accounting (Tax optimization and Offshore companies).

The so-called “Sulik´s 100” lowered the quality criteria for audit obligations. As of the 2022 financial year, only those companies that meet at least 2 of the following 3 criteria may be subject to an audit:

- total assets exceed 4 000 000 EUR;

- the net turnover exceeds 8 000 000 EUR; and

- the average number of employees in one accounting period exceeded 50;

Although the audit obligation is not popular among smaller businesses, it should be noted that the double-entry bookkeeping audit naturally contributes to the institutionalization and standardization of economic reporting. At the end of the day, this improves the overall predictability of financial indicators and adds confidence to business relationships.

In other words, double-entry bookkeeping audits of trading companies are generally beneficial for economic growth. Unfortunately, a certain degree of aversion to auditing has developed in Slovakia, mainly due to the impractical and formalistic approach of some auditors, seen as both insensitive and arguably detached from reality.

Fund accounting

We have long been involved in funds, their establishment, and business regulation. We have established several small funds in Slovakia, the first Slovak venture capital fund EuVECA, and several offshore funds. We organized the first Slovak conference on setting up of small investment funds, attended by 125 individuals (business professionals, regulators, advisors). Thanks to our legislative initiatives, SICAV can now have two types of shares or a sub-fund and qualified investors. We enjoy a unique position in Slovakia thanks to our legal, tax, and accounting advice on funds.

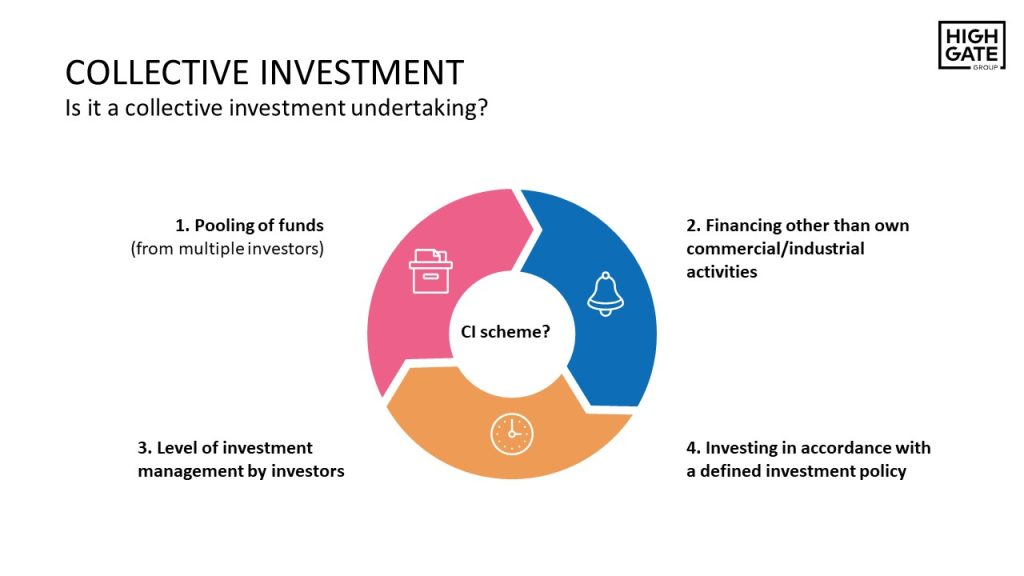

We naturally think of a fund as a large, institutionalized entity managed by a multinational fund management company. However, funds are also set up by small businesses planning to raise money from the public, or by private placements/offerings aiming to invest and capitalize on it. This is a collective investment.

In its legislative development, Slovakia has not emphasized a more sophisticated regulation of small investment funds. This shortcoming is reflected in the ossified regulatory framework, as well as in taxes and contributions. Taxes can be a clincher when deciding whether a fund should be established in Slovakia or abroad. This places Slovakia at a significant disadvantage compared to other EU jurisdictions.

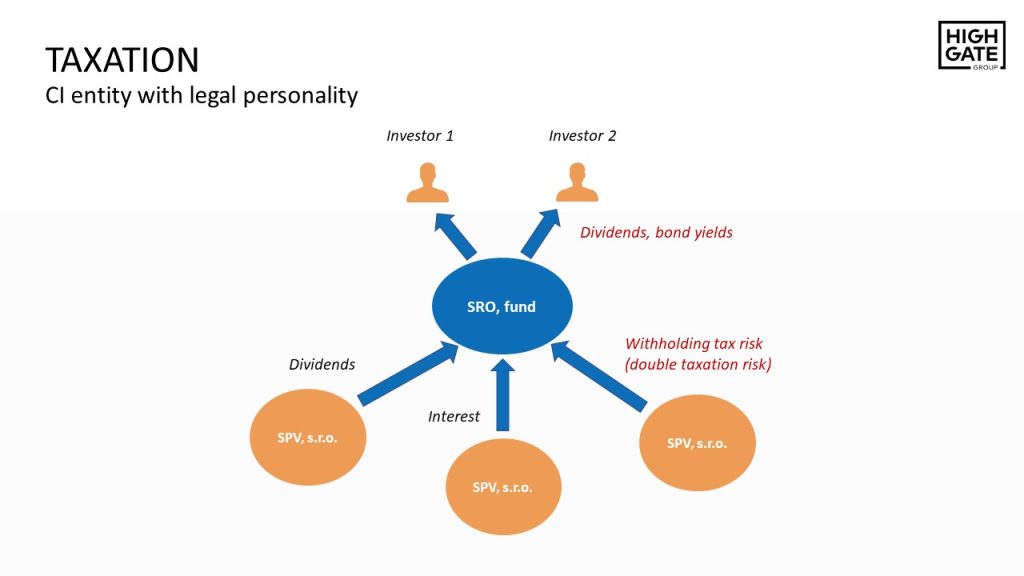

Even the Czech Republic offers a favorable tax regime for several types of funds, on top of other regulatory options. The Slovak Income Tax Act does not provide significant tax advantages for funds, and worse, their tax liability is to a large extent determined by the way their accounting is done. In fact, the fund accounting procedures in force require (in certain circumstances) a fund to revalue its assets on an income method basis.

This means that, for some funds, taxation may result in an increase in the fair value of the underlying assets (fund taxation). Moreover, such accounting practices are relatively obscure and non-transparent. The statistics on the number of small investment funds, whose accounting is not done in line with the administrative rules, alone indicates the regulatory quagmire of the Slovak fund industry today.

Collective investment law is largely harmonized by the EU UCITS and AIFM Directives. The definition of collective investment -separating regulated from unregulated structures- is thus also largely standardized across the EU Member States. The foreign regulators´ instructions and practice are the source of information when interpreting this law.

In the context of collective investment law, we address the regulatory and legal circumstances, in addition to tax and accounting issues. We represent clients before the NBS in various processes including registration and authorization proceedings. For more information on collective investment regulation, please refer to these articles:

We provide proper small fund accounting. This service is suited to small businesses in the fund industry (real estate, financial instrument, or cryptocurrency investment funds), and startup hubs through which investors invest in venture capital (risk capital). As we are the only office in Slovakia with experience in the legal, tax, and accounting aspects of venture capital funds (EuVECA), we are confident that we can provide adequate services in this area.

A mutual fund is just one legal form in the range of Slovak investment fund legal forms. It represents a pool of assets and therefore has neither a legal nor tax personality. Individual shareholders (unitholders) hold unit certificates, which represent a confirmation of a share in the fund’s assets. Accounting is done separately. Although, historically, mutual trusts have been and are used primarily for conservative funds (especially UCITS), mutual funds can be nicely structured as a part of tax optimization for investments in cryptocurrencies, securities, or real estate (i.e., for AIFs).

OUR COURSES AND TRAINING

- How can I (efficiently) tax income from securities, derivatives, or cryptocurrencies? Can I avoid taxation altogether?

- Want to get paid through the company, legally and tax-efficiently, as a partner? There are multiple options.

- Is it better to buy an apartment/chalet/securities as a natural or legal person?

- Is a trade license or LLC better for me? What about social insurance contributions? Can I, as a self-employed person, invoice my own company?

- Scaling business abroad, using offshore companies. Can I pay 0% tax abroad?

- How can I prepare a company for a sale or investor entry?

- What are the available and effective options for external Company financing?

- How can I negotiate a good term sheet with an investor?

- What should I watch out for when preparing a shareholders' agreement?

- What are the shareholder dispute resolution options?

- What are the options and advantages of different forms of employee stocks and shares (ESOPs)?

Law & Tax

Tomáš Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk