Representation in tax proceedings

How can we help?

In addition to tax advice and accounting, we represent clients in proceedings before the tax authorities and courts. This fusion of legal and tax advice adds value in litigation proceedings.

Our client representation services

We represent clients in tax litigation through our law firm, Highgate Group. A selection of services we offer:

- representation before the Financial Administration;

- representation before the courts;

- analysis of asset protection and business structuring options prior to tax audits and during any of the procedural phases of tax or court proceedings, with an emphasis on the protection of the entrepreneur's assets and business continuity.

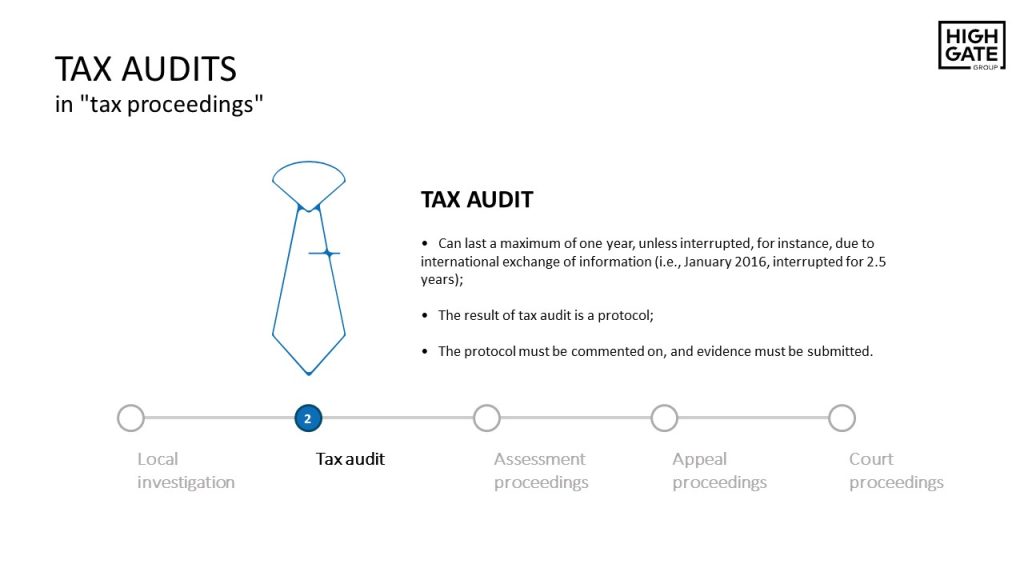

Tax audits in Slovakia

The issue of tax audits in Slovakia is a topic by itself in the tax law realm. It affects the technical level of taxation and law, as well as the practical level of our society. Tax audits can interfere in a very invasive way with the existence of the company and the individual in charge.

We believe that the social situation in Slovakia has improved. Previously, tax audits were the tool of choice in political or business struggles.

These practices appear to be a relic of the past, but the recent practice of tax audits suggests that we are facing a different malaise – the lack of specialization of public authorities’ employees and, in the case of the VAT, an attempt to satisfy the State at the expense of innocent taxpayers (more in Peter Varga´s interview for Trend). The resulting decisions are unreasonably unforeseeable in a state governed by the rule of law.

In recent years, tax law has become significantly more complicated at both the legislative and caselaw levels. There already are rulings on the Schwarz system (Labor law, including the issue of the Schwarz system), invoicing one’s own company, or rulings concerning abuse of law (Tax optimization – Domestic and Foreign Options).

If an administrative authority or a court are to rule in accordance with the rule of law, and so there are no unreasonable differences between rulings, the issue must be dealt with in detail. This is problematic given the lack of specialization.

Adding to the complexity of tax law is the greater diversity of economic relationships. Not only the phenomenon of cryptocurrencies, but also the standard transactional advice is nowadays being carried out in ways and volumes unseen in Slovakia. In the absence of a qualitative shift, it is possible to encounter misunderstanding.

For the sake of client protection, the more complicated structures and settings must be presented in a way that fits within the recognizable public authority frameworks.

VAT audit

Imagine a company buys goods for 10 EUR + 2 EUR VAT and then sells them for 12 EUR to the Czech Republic as an intra-Community supply (EU´s intra-Community transactions & acquisition of goods/Intra-Community chain transaction). The company’s margin is 2 EUR.

If the company has variable and fixed costs of 1 EUR attributable to this particular transaction, its profit before tax is 1 EUR.

Say this company belongs to a chain of companies where tax fraud has potentially occurred at one of the levels. There is no direct link between the company and the arguable transaction. An indirect subcontractor might have failed to declare the output VAT and stopped communicating with the tax authorities.

The tax administrator often focuses on the healthy entity in the supply chain, to which the right to VAT deduction would not be granted (2 EUR in our case). As 2 EUR is a multiple of the company’s profit from the transaction, consumer goods companies trading in more routine frameworks are exposed to risk. An enforceable ruling of the tax authorities can force a company into bankruptcy, and an entrepreneur into personal bankruptcy.

A common phenomenon is the ‘double dip’, i.e., the non-recognition of a delivery by this company to another Member State in the same supply chain.

This can lead to an obligation to pay the tax authorities, in our case 2 EUR (i.e., non-recognition of the right to deduct VAT), and an additional 2.4 EUR (i.e., non-recognition of the intra-Community supply). VAT audits can have devastating consequences, especially for consumer goods companies.

In addition to representation and tax advice in connection with tax audits, we provide combined legal and tax advice on structuring clients´ businesses and asset protection.

Income tax audit

Nowadays, income tax audits are statistically less frequent than VAT audits.

The level of their intrusiveness is also significantly lower. This is supported by case law and theories of income taxation, which emphasize the material over the formal aspect of income tax. Thus, in the context of the above example, the tax authorities should not reject the cost of the goods purchase as a tax expense if there is an attributable taxable income. However, today´s tax audits focus more on the regulation of transfer pricing.

The attention of the Financial Administration has gradually been on the Transfer pricing.

Tax audit defense before the tax authorities

Taxpayers increase the chances of success in litigation by already choosing a legal (tax attorney) representation at the tax audit stage. Note that the tax proceedings are largely procedural, and even a minor procedural lapse on the part of the tax administrator may ultimately result in the annulment of the tax administrator’s decision by the court.

It is crucial that the evidence and arguments be presented by the taxpayer consistently and in a logical sequence. There is a substantial body of case law that ‘rewards’ authenticity in proceedings. The natural manner of business conduct in commercial relations, coupled with a proper interaction with the tax authorities (including cooperation), must be supported by strong legal and tax arguments in the written submissions to the tax authorities. These too must be consistent and presented in an unambiguous manner. Written submissions must be formalized so as to inspire transparency.

Tax disputes in court

Should the taxpayer fail before the Financial Administration, and its decision becomes final and enforceable, the taxpayer may take the administrative action to court. In the court proceedings, the taxpayer must be legally represented.

The taxpayer may ask the court to postpone the enforceability of the Financial Administration´s decision to prevent enforcement proceedings from being initiated before the court has ruled on the merits of the case. Such a tax dispute can be brought before the European Court of Human Rights.

This is where the authenticity of the taxpayer’s conduct before the tax audit and during the individual tax proceedings comes into play. The complaint (or cassation complaint) is usually founded on proven facts and enumerates the procedural and/or substantive aspects of the dispute. An attorney must proceed with caution when explaining the substantive issues. The submission must not be ‘overcomplicated’, unclear, or inconsistent. It is also important the attorney knows and understands the economic side of the matter (i.e., taxes and accounting).

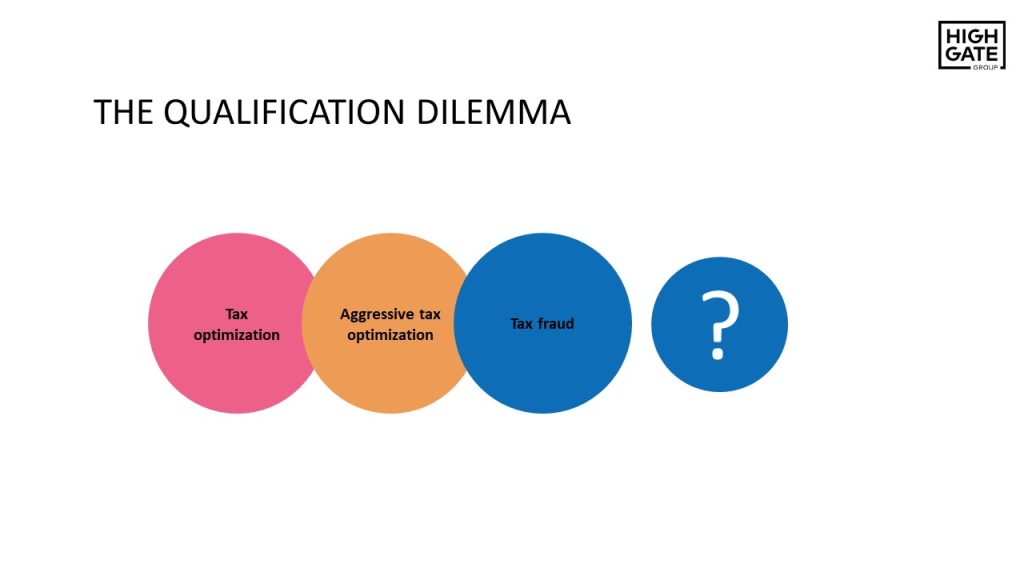

Taxes and criminal liability

Under Slovak tax law, not every illegal tax optimization qualifies as a tax offence. As with the identification of what is and what is not lawful in minimizing tax or contribution liability, the line between criminal and administrative law (Tax Optimization – Domestic and Foreign Options) in regards to tax offences is vague.

Text from the slide:

Unfortunately, Slovak tax law does not have extensive clarifying case law, where courts or prosecutors might focus on delineating more precise boundaries. From a business point of view, it is not at all comfortable to be unable to foresee the penalty for a tax offence committed. In this context, imprisonment (in conjunction with the penalty of asset forfeiture) is indeed the most serious potential personal risk.

A majority of Slovak entrepreneurs can relate to the case of Andrej Kiska’s KTAG. From the rule of law perspective, it is unproblematic that the he was charged with tax evasion and insurance fraud. Rather more troubling is that previous tax administrators and law enforcement authorities had never before indicated the accused conduct exceeded the criminal threshold. This second point impacts a huge number of entrepreneurs who potentially may be exposed to the prospective arbitrariness of the State which seeks to criminalize heretofore acceptable conduct.

Our services

We provide comprehensive services in the field of tax consulting and tax optimization (Tax optimization – Domestic and Foreign Options). In addition to technical advice, this also includes legal analysis with an emphasis on analysis of likely criminal risks.

Clients typically use our services in the following situations:

- transactional advice, which also includes tax advice;

- when assessing an existing tax and legal structure;

- when setting up a client's business with an emphasis on tax – contribution efficiency;

- when representing a client before the tax authorities or courts.

Practical examples – Case studies

Case 1: A company makes a profit. However, it does not pay the profit to the shareholder as a dividend, but instead gifts it to the shareholder, thus avoiding dividend taxation. Slovak legislation does not formally prohibit this. It can be regarded as:

- legal tax optimization (avoiding taxes on dividends);

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 2: A well-known athlete moves to Monaco and becomes a Monegasque tax resident. However, he spends a large part of the year in Slovakia at various marketing events, staying over in his Bratislava apartment or hotels. If he does not tax his worldwide income in Slovakia, it is:

- legal tax optimization (avoiding Slovak taxes);

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 3: An entrepreneur purchased a family car from which she deducted 100 % VAT and treats 100 % of the car depreciation as a taxable expense. However, she uses the vehicle exclusively for family transfers. This is:

- legal tax optimization;

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 4: An entrepreneur owns two companies. Before the end of the calendar year, the preliminary results showed that one company was expected to make a profit of €1 000 and the other a loss of €500. Therefore, the entrepreneur decides to invoice €400 from the loss-making company to the profitable company for marketing services, thus reducing tax liability. This is:

- legal tax optimization;

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 5: An entrepreneur set up a company on a Caribbean Island with a 0% tax rate, and from which she invoices her IT services to Slovak clients. However, the entrepreneur is mainly based in Slovakia when performing the services. This is:

- legal tax optimization;

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Our services in the field of employment of "contractors"

We provide:

- financial analysis of the impact of employing "contractors";

- comparison of LLC with trade license for client's contractors;

- analysis of the impact on social insurance benefits for specific natural persons;

- analysis of the limits and possibilities of employing "contractors" in light of current case law with regard to the "Schwarz system";

- drafting of cooperation agreements with regard to:

- the elimination of risks associated with the "Schwarz system";

- protecting the company from "bad leaver" situations;

- protecting IP and other company assets.

Labor law at Highgate Group

Highgate Group is a tax and accounting firm and a law firm. Our clients can meet a payroll accountant or a labor lawyer here. We are confident that this concept adds value for our clients and colleagues alike.

It also places clients – as recipients of payroll accounting services – in a more comfortable position. We are aware that other accountants often gather legal knowledge and awareness by searching the Internet. Such information may be misinterpreted and outdated.

Templates of legal documents

Our clients are welcome to use a range of free legal document templates prepared by Highgate Group, including employment contracts, termination agreements, cooperation agreements, and more.

This is an important topic, given the significant difference between standard employment and employment of a trade license holder (self-employed person). We address this situation from the tax, contribution, and legal perspectives, including with an eye to social insurance benefits.

An employee´s gross salary is 2000 EUR. He agrees to obtain a trade license and invoice the employer 2000 EUR for his work.

If:

- the employee has one dependent/ minor under the age of 6 for whom he claims a tax bonus;

- he does not claim any other tax bonus;

- he does not claim the non-taxable part of the tax base for a spouse nor any other non-taxable part except that under §11(2) of the Income Tax Act;

- as a self-employed person, he claims flat-rate expenses;

- as a self-employed person, he is subject to an annual social insurance settlement;

- as a self-employed person, he does not pay unemployment insurance;

- the employer has a positive tax base;

- the employer is subject to a 21 % tax rate.

What are the tax and contribution implications for both legal forms? The figures reflect the tax and contribution rates in force in the second half of 2021.

| EMPLOYEE | SELF-EMPLOYED | |

|---|---|---|

| Gross salary | 2 000 EUR | – |

| Employer cost | 2 704 EUR | 2 000 EUR |

| Health insurance contribution | 268 EUR | 76 EUR |

| Social insurance contribution | 704 EUR | 181 EUR |

| Income tax | 211 EUR | 15 EUR |

| Net total | 1 521 EUR | 1 728 EUR |

| Employer's tax shield | 568 EUR | 420 EUR |

| Employer cost | 2 136 EUR | 1 580 EUR |

The financial differences between the two are significant for both the employer and the “employee”. Nevertheless, should the employee, as a self-employed person, be in the ‘contribution holiday’ regime, the financial difference would be even more significant:

| EMPLOYEE | SELF-EMPLOYED | |

|---|---|---|

| Gross salary | 2 000 EUR | – |

| Employer cost | 2 704 EUR | 2 000 EUR |

| Health insurance contribution | 268 EUR | 76 EUR |

| Social insurance contribution | 704 EUR | 0 EUR |

| Income tax | 211 EUR | 52 EUR |

| Net total | 1 521 EUR | 1 872 EUR |

| Employer's tax shield | 568 EUR | 420 EUR |

| Employer cost | 2 136 EUR | 1 580 EUR |

It is a whole new tax-contribution ball game if the contractor cooperates with the company by means of his own legal entity. Two other aspects come into play then that can significantly affect the resulting savings figure.

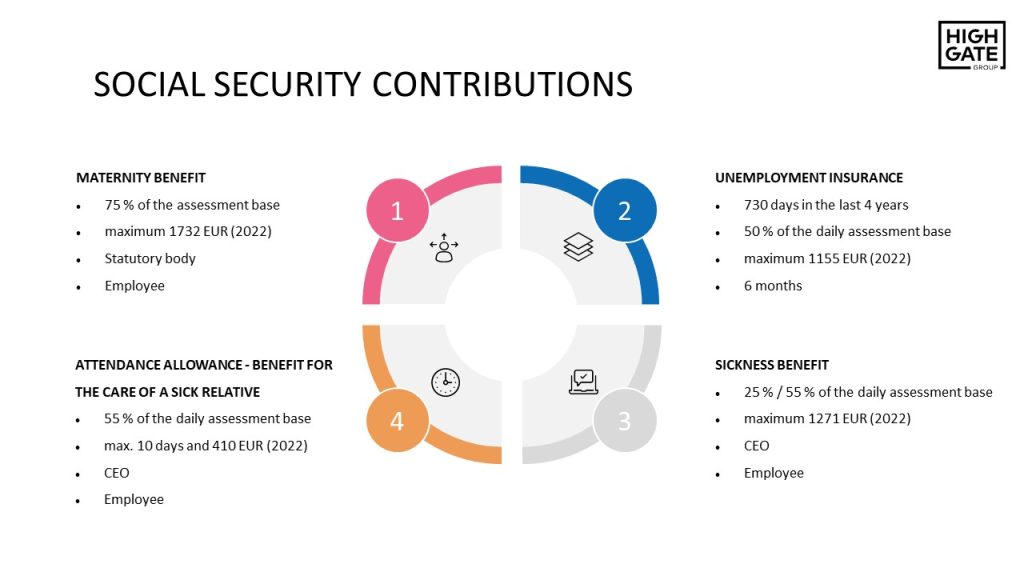

The advantages of self-employment cannot be viewed in isolation through the lens of the two tables only. Completing the picture is the impact on social insurance benefits, the amount of which varies depending on circumstances, including the legal form of the natural person´s economic activity.

The social security benefits situation is also different for contractors who provide their services by means of a legal entity.

Self-employment & Maternity leave

Maternity benefit entitlement is conditioned upon the continuance of sickness insurance for a minimum of 270 days in the last two years prior to childbirth. Should a self-employed person be in the contribution holiday regime and not pay social security contributions as a voluntarily insured person, they may not be entitled to a maternity benefit. The maternity benefit is equal to 75% of the daily assessment base. The daily assessment base is derived from the average of the assessment bases in the reference period. The reference period varies from case to case. To simplify, the amount of maternity benefit for a self-employed person depends on how much and when the self-employed person contributed to social insurance/security.

However, it is with maternity benefits that the Social Insurance Act allows for methods of self-employed persons receiving the maximum maternity benefit. The maximum amount of maternity benefit (31-day months) is gradually approaching 2 000 EUR. For more information, arrange a personal consultation with Peter Varga. Our accounting clients enjoy a 50% discount.

Self-employment & Sick leave

Self-employed persons may be found unfit for work in the event of illness, accident, or quarantine. The standard amount of sick leave benefit depends on individual social insurance contributions and the type of sick leave (the amount may be different for pandemic related sick leave).

If the self-employed person qualifies for a sick leave benefit (as a social security contributor or if in the “protection period”), the amount of the benefit is comparable with that for employees:

- 25 % of the daily assessment base from the 1st to the 3rd day of work absence;

- 55 % of the daily assessment base from the 4th day of work absence.

The daily assessment base depends on several factors. The self-employed who use flat-rate expenses enjoy a lower assessment base for social insurance contributions. This also impacts the daily assessment base. Note that a self-employed person cannot estimate the amount of benefit in advance as accurately as in the case of a maternity benefit.

Self-employment & Attendance allowance

An attendance allowance became a prominent social supplement during the pandemic and school closures. It helped employees, the self-employed, and employers alike overcome pandemic period cash-flow difficulties.

The self-employed are entitled to an attendance allowance provided they pay social security contributions or are in the protection period. The attendance allowance amount depends on the daily assessment base. It is derived from the contributions the self-employed person made to the social security system in the ‘reference period’. The amount of the attendance allowance is 55 % of the daily assessment base. Thus, like the sickness benefit, the amount of the attendance allowance for the self-employed is influenced by the lower contribution obligation as compared to employees.

Self-employment & Pension

Although pensions are an abstract topic for many of our clients’ contractors, some are interested in analyzing the effects of conversion to self-employment on future pensions. The merit principle applies to pensions – the more one contributes to the social system, the higher the pension. However, a social element plays a role here – pension ceilings, the coefficient for higher pensions, as well as the minimum pension system.

For example, if the conversion from employment to self-employment involves a drop in monthly pension of 200 EUR, it adds up to 36 000 EUR in 15 years. That is a significant amount. We help our clients analyze this aspect, too.

Self-employment & Unemployment insurance

A self-employed person is entitled to unemployment insurance only if they have paid voluntary contributions to unemployment insurance for at least two years in the 4 years preceding their inclusion in the Jobseekers Register. The self-employed only fulfil the benefit eligibility criteria if they have paid contributions to voluntary unemployment insurance.

The unemployment benefit amounts to 50 % of the daily assessment base, which is derived from the average of the assessment bases in the reference period.

The reference period for determining the daily assessment base is different here than for maternity or sickness benefits. It is the two-year period preceding the date on which the unemployment benefit was due.

It is not. In addition to an administrative sanction, using the Schwarz system may qualify as a tax offence (in particular, tax evasion and insurance fraud). When establishing relations with contractors or converting employees to contractors, it is essential to approach this action as a project deserving legal consideration and attention. The goal is not only to minimize the risks of government sanctions, but also set up contractual relationships with contractors in such a way that the company is protected (e.g., IP rights).

Case law is not uniform. Inspiration is to be found in the Czech case law, which coined the term “Schwarz system”, and produced an extensive collection of court decisions. We use these to set up defensible legal, tax and contribution frameworks for the employment of self-employed persons (sole proprietors – trade license holders). It is a whole new tax and contribution ballgame if the contractor works with the company by means of an independent legal entity.

Our offshore advisory services

A selection of our most popular services:

- analysis of the client's existing structures with respect to the latest tax regulations and anticipated changes;

- analysis of the client's existing structures with respect to criminal liability risks;

- ways to use a foreign offshore company in specific business situations;

- practical advice related to the establishment and use of an offshore company.

An offshore company isn´t just a company incorporated and existing in the jurisdiction of one of the Caribbean islands. Offshore companies can also be Czech holding companies, which until recently were often set up by Slovak tax advisors to avoid capital gains taxation in Slovakia in the event of a successful EXIT. Even the recent sale of a well-known Slovak IT company was executed through an offshore Austrian holding company. An offshore company isn´t just one based in a tax haven and established for the purposes of reducing an entrepreneur’s tax liability.

An offshore company is any company not based in the founder’s domiciled country or the country where the functions and risks associated with the income it generates are carried out and borne. An offshore company may be located in the Czech Republic just as often as in the British Virgin Islands. Offshore companies are also established with a view to achieving a degree of anonymity. It used to be standard practice to hide assets via offshore companies with the legitimate aim of protecting them from various vested interests or violent interests. In South America, Russia, or Ukraine, it is still relatively common for some entrepreneurs to conceal their assets to protect their lives and those of their family members. Slovak entrepreneurs, too, have experience with the dark side of asset transparency, attributable to public access to information on company accounts.

Our clients often seek help with achieving greater anonymity for their assets. There´s a set of reasons – from illegitimate motives associated mainly with criminal activities, to the need to protect the entrepreneur and his family from the attention or unreasonable demands of his business partners or employees. Offshore companies are also set up with the intention of avoiding administrative or regulatory restrictions.

In Slovakia, the business register often does not function in line with legal requirements. The processing of filings tends to be delayed for unreasonably long periods of time, thus creating a legitimate demand for the establishment of companies in other countries. Does this legitimize the use of a favorable tax regime abroad? The same goes for regulation. If Slovak or European legislation allow entrepreneurs to do business in certain areas (e.g.: securities trading or collective investment funds) only with regulatory difficulties, entrepreneurs naturally look for more flexible offshore solutions.

Slovakia is a small country, which naturally does not have the expert infrastructure or the ambition to build a full-fledged legislative framework for cryptocurrencies and related business.

The result is an uncertain environment unsuitable for larger projects – owing to the unpredictability of the decision-making of the relevant Slovak authorities. This caused several Slovak cryptocurrency and blockchain projects to consider moving their legal presence abroad. Where this is the case, they are producing offshore companies.

Is it legal?

Can the state interfere with this freedom and force entrepreneurs to tax foreign profits in Slovakia?

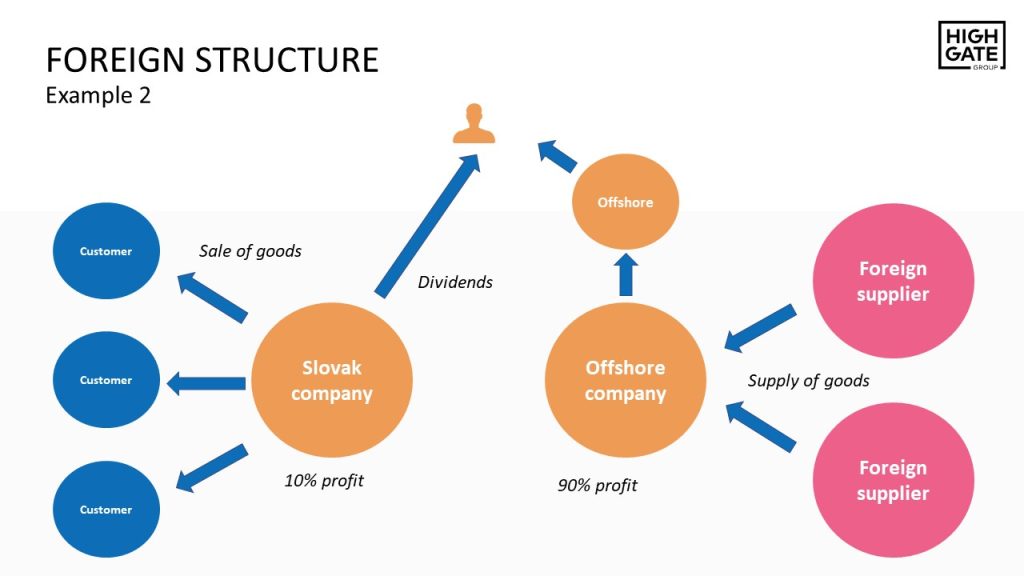

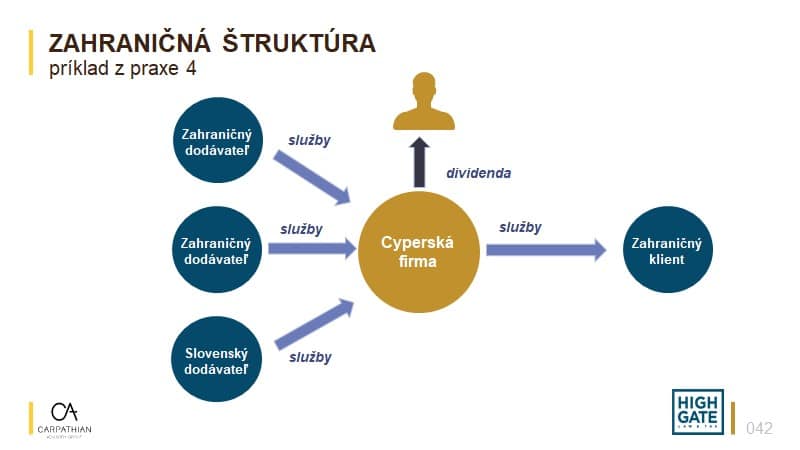

The establishment of an offshore company in any tax haven is not inherently illegal. However, its subsequent use may become illegal. Back-to-back fictitious supplies of services from tax havens via the Netherlands or the UK to a Slovak company are still common. The entrepreneur is thus able to shift profits from the 21% tax rate band (Slovakia) to the 0% tax rate band (tax haven).

On the other hand, there are situations where the use of a company based in a 0% tax rate country may be perfectly legal and legitimate. The fact that a country does not tax corporate profits isn´t by itself problematic.

As demonstrated by the Patent Box sub, optimization for IT & development firms, or Super Deduction for R&D, a 0% rate can even be achieved in Slovakia.

To do so, it is necessary to make use of such an offshore company for legitimate reasons (e.g.: PR, investor requirement, more favorable legal environment, etc.).

Slovakia has gradually adopted several legal regulations to discourage Slovak entrepreneurs from the illegitimate use of foreign offshore companies, especially for tax avoidance purposes. These include:

CFC rules for natural persons

These are to ensure that the natural person responsible for a foreign offshore company taxes the company´s profits. For more on this topic, see the video “Is it even worth owning an offshore company nowadays? If so, for whom and when?“. For Peter Varga’s critique of these rules, see My remarks to the Ministry of Finance (CFC rules for natural persons).

CFC rules for legal persons

Many taxpayers are unaware of the existence these rules. They are to ensure that a foreign offshore company´s profits are taxed by the associated Slovak company, provided that the involvement of the foreign offshore company resulted from one or more actions which are not genuine or were taken for the purpose of obtaining a tax advantage.

35% tax rate

Certain cross-border payments made by a Slovak company are subject to a 35% withholding tax rate in Slovakia. On the other hand, certain Slovak recipients´ dividends, liquidation proceeds, or buyouts are subject to a 35% tax rate in Slovakia. This makes it problematic to “just like that” use a company established in the UAE.

Place of effective management (POEM)

By analyzing the company´s POEM, the tax administrator can assign Slovak tax residency to a foreign company even though the company is legally established and existing under another legal system.

Final recipient

When applying withholding taxes, the tax administrator may audit the Slovak taxpayer to see whether he has investigated who the ultimate recipient of the income paid is. The aim is to prevent the use of shell holding companies or other intermediaries.

Transfer pricing

he perception of transfer pricing is underdeveloped in Slovakia. The OECD Transfer Pricing Guidelines envisage its use even in situations where the taxpayer would not ordinarily expect it. These include various internal reorganizations and transfers of activities from one company to another. Such activities should be taxed.

Miscellaneous

In addition to further technical provisions, acts, and judicial practice, there are also substantive policy tools. These are various forms of substantive fairness or abuse of discretion under which a tax administrator may, in certain circumstances, act against a structure that does not formally contradict the wording of the tax regulations.

The analysis of the possible use of an offshore company in a particular setting for a particular client should not only include tax and accounting elements. The structure must be looked at through legal and practical lenses.

Suppose an entrepreneur wants to take advantage of tax exemption on profits from the sale of stock or a business shares in Cyprus. She does not want to spend on an adequate advisor and makes do with the Internet and her Slovak accountant. She learns on the internet that Cyprus does not tax such profits, finds a company that sets up a Cypriot company and provides a registered office, and her Slovak accountant approves the plan.

Should she involve a competent tax advisor in this structure, she soon learns that there is another dimension to this type of tax optimization. Questions may arise:

- Can the Slovak tax office consider the Cypriot company a Slovak company? How can this risk be eliminated?

- Are the CFC rules for natural and legal persons not applicable to the Cypriot company?

- Are Cypriot company´s profits from any disposition of shares or stock really not taxable? Are there no exemptions?

An attorney sheds light where written law lacks answers. She uses caselaw, analysis of various interpretations of the law (teleological, grammatical, historical, etc.) as well as the philosophy and theory of law to resolve unclear situations. The following topics may be covered:

- If the tax office takes a different view of the entire structure, has the entrepreneur committed tax evasion and insurance fraud?

- If the Cypriot company rents some premises, will this be sufficient "substance" for the purposes of Slovak tax law? Where does this fit within the framework of the EU right of establishment in another EU country?

- Can the sale of a business share through the Cypriot company be considered fraud/ abuse of law?

Relevant practical experience with tax optimization is crucial. It can help with the following:

- How much does it cost to set up and maintain such a company?

- What are the trends and what can be expected in the future?

- Is a company audit mandatory (with the associated considerable increase of the document administration cost)?

- Where is it possible to open a bank account?

- Will banks have a problem with income sourced in Slovakia? What could the consequences be?

- How much does the liquidation of such a company cost?

VAT audits

Much of our representation in tax proceedings is in VAT audits. VAT audits occur more frequently than income tax audits (e.g., in connection with illegal tax optimizations). In Slovakia, VAT is a major source of revenue for public budgets. It is the second most profitable tax for the State after the income from social insurance contributions. Analysis of the last 10 years (cash methodology) shows that VAT makes up 44% of the state´s total tax revenue. Corporate income tax only accounts for 18%.

Another reason the State places so much emphasis on VAT is the VAT loophole. The loophole represents an estimated VAT evasion, as VAT is among the riskiest in terms of tax evasion. The peak of VAT collection inefficiency in Slovakia was in 2012, when the VAT loophole reached 40% of the VAT collection potential. The gap is much smaller today, but still relevant. This is a significant step forward and explains why the State has decided to relax some of the VAT law provisions (e.g., the abolition of the mandatory guarantee).

While one can generally agree with the dynamics and emphasis that the State has placed on VAT collection and tax audits in recent years, there are limits to this approach. It seems that in many cases these limits have been exceeded, which should not occur in a state governed by the rule of law. Courts must be able to identify those limits reliably and consistently and cultivate a much-needed legal certainty in the business environment. It is our job as tax attorneys and advisors to sensibly inform the courts of the tax authorities´ slip-ups.

You can find other interesting tax audit stories in our press releases, articles, and seminars. It is a common topic of our conferences (link to the conferences). We would like to draw your attention to the interviews for Trend (Attorney: Tax audits are often purposeful and absurd) or (You should have known! How tax authorities hunt for healthy companies) and Hospodárske noviny (Are tax audits still problematic even for honest companies?)

OUR COURSES AND TRAINING

- How can I (efficiently) tax income from securities, derivatives, or cryptocurrencies? Can I avoid taxation altogether?

- Want to get paid through the company, legally and tax-efficiently, as a partner? There are multiple options.

- Is it better to buy an apartment/chalet/securities as a natural or legal person?

- Is a trade license or LLC better for me? What about social insurance contributions? Can I, as a self-employed person, invoice my own company?

- Scaling business abroad, using offshore companies. Can I pay 0% tax abroad?

- How can I prepare a company for a sale or investor entry?

- What are the available and effective options for external Company financing?

- How can I negotiate a good term sheet with an investor?

- What should I watch out for when preparing a shareholders' agreement?

- What are the shareholder dispute resolution options?

- What are the options and advantages of different forms of employee stocks and shares (ESOPs)?

Law & Tax

Tomáš Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk