Tax & contribution optimization

Tailored advice for domestic and cross-border tax optimization

What can we help you with?

We strive to set up our clients’ businesses in a tax and contribution efficient manner. We deal with optimization from a tax perspective, while also looking out for legal challenges and practical implications.

It is also one of the key topics of our external lectures and business conferences. This includes the largest legal and tax conference in Slovakia, which we had the privilege of organizing and presenting at. We comment on this topic in the media, publish articles, give lectures, and organize training sessions and webinars.

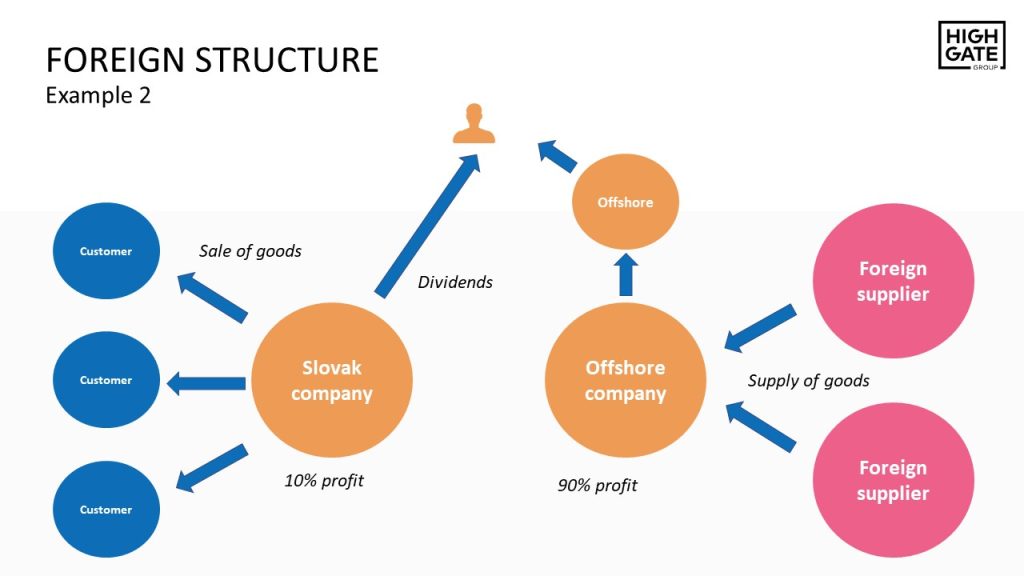

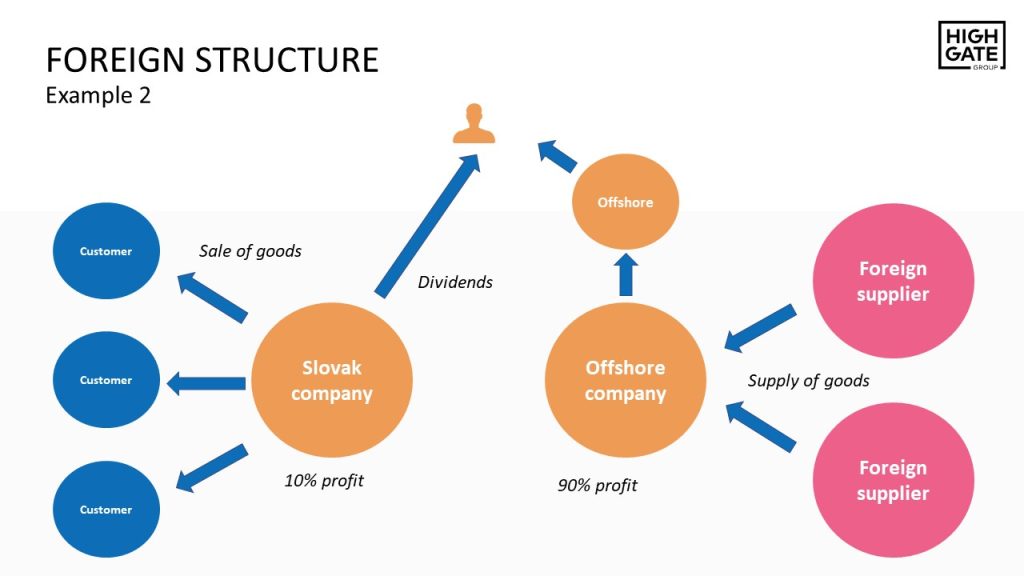

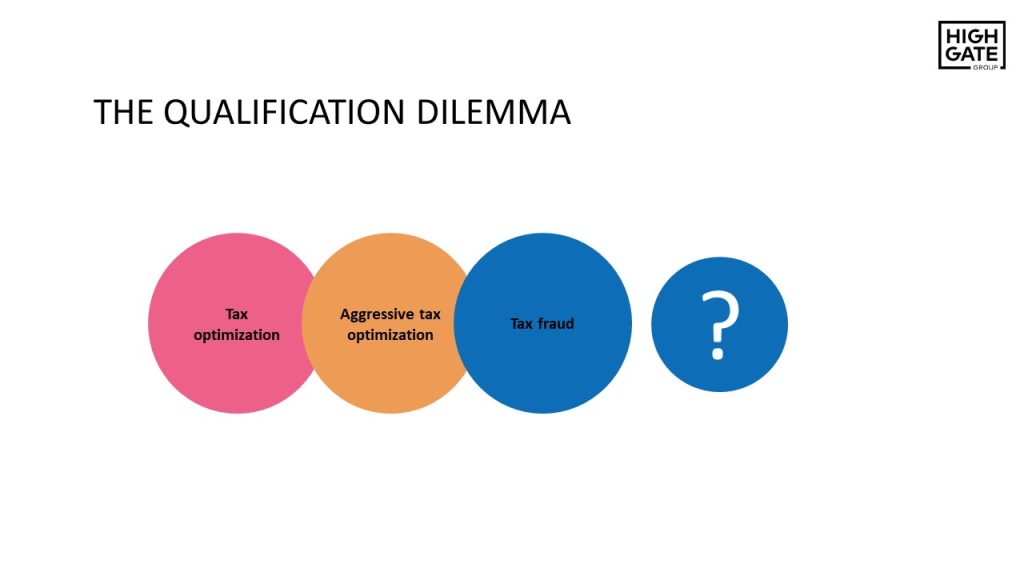

Generally, tax optimization must be founded on genuine business or legal reasons. It must be “honest” to be defensible before the tax authorities and courts. If so, it qualifies as legitimate tax optimization, something the State will not perceive as non-compliant with the law. Choosing between an LLC or self-employment, even if only for determining most favorable tax treatment, is legal and a legitimate tax optimization strategy. The same applies for selling, for instance, a shopping mall, where one decides between a sale and a transfer of the business. On the other hand, running several non-VAT businesses to avoid VAT registration is aggressive tax optimization that can have criminal implications. So does setting up a company in a country with a lower tax rate without operating any business there.

A selection of topics we advise on in the field of tax and contribution optimization:

- How to tax income from securities, derivatives, or real estate? Which tax reduction options are legal?

- How to get paid through the company legally and tax-efficiently as a partner? There are multiple options.

- Is it better to buy a condo/chalet/securities as a natural or legal person?

- Is a trade license or LLC better for me? What about social security contributions? Can I, as a self-employed person, invoice my own company?

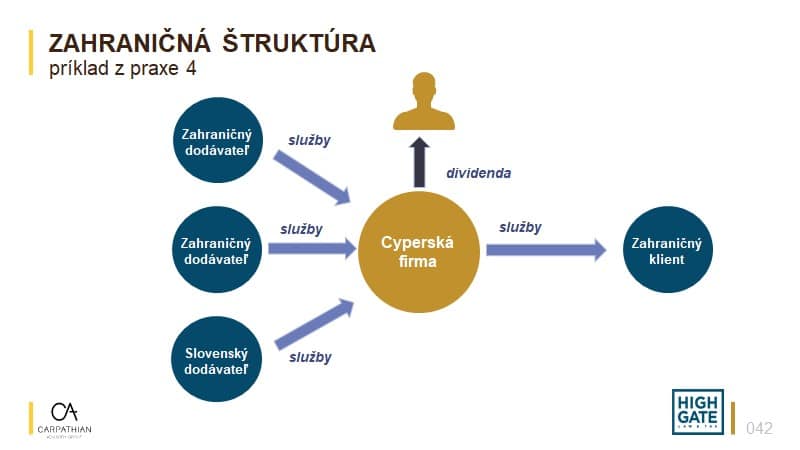

- Scaling business abroad, using offshore companies. Legal and practical implications;

- Use of preferential tax regimes in Slovakia (e.g., Patent Box or Super Deduction);

- Minimum remuneration in your own company and setting of social insurance benefits.

Tax optimization - Foreign Options

Optimization options expand with cross-border business. Never has the movement of people and goods been as easy as it is today. Nor has it ever been so easy to provide services from one side of the world to a customer on the other side of it. In a world where borders are blurring, distances are becoming relative and multiple business opportunities, increasingly real. This open world provides opportunities to exploit individual countries´ tax advantages to optimize taxes, the flow of funds, and asset protection.

However, international tax rules and regulations are in constant flux, while deepening globalization complicates the taxation of cross-border and domestic operations. We have an in-depth understanding of the regulations, allowing us – in collaboration with our foreign partners – to assist our clients with the design and implementation of efficient and effective tax structures meeting the current regulatory requirements.

- analysis of the client's existing structures with respect to the latest tax regulations and anticipated changes;

- analysis of the client's existing structures with respect to criminal liability risks;

- ways to use a foreign offshore company in specific business situations;

- practical advice related to the establishment and use of an offshore company.

An offshore company isn´t just a company incorporated and existing in the jurisdiction of one of the Caribbean islands. Offshore companies can also be Czech holding companies, which until recently were often set up by Slovak tax advisors to avoid capital gains taxation in Slovakia in the event of a successful EXIT. Even the recent sale of a well-known Slovak IT company was executed through an offshore Austrian holding company. An offshore company isn´t just one based in a tax haven and established for the purposes of reducing an entrepreneur’s tax liability.

An offshore company is any company not based in the founder’s domiciled country or the country where the functions and risks associated with the income it generates are carried out and borne. An offshore company may be located in the Czech Republic just as often as in the British Virgin Islands. Offshore companies are also established with a view to achieving a degree of anonymity. It used to be standard practice to hide assets via offshore companies with the legitimate aim of protecting them from various vested interests or violent interests. In South America, Russia, or Ukraine, it is still relatively common for some entrepreneurs to conceal their assets to protect their lives and those of their family members. Slovak entrepreneurs, too, have experience with the dark side of asset transparency, attributable to public access to information on company accounts.

Our clients often seek help with achieving greater anonymity for their assets. There´s a set of reasons – from illegitimate motives associated mainly with criminal activities, to the need to protect the entrepreneur and his family from the attention or unreasonable demands of his business partners or employees. Offshore companies are also set up with the intention of avoiding administrative or regulatory restrictions.

In Slovakia, the business register often does not function in line with legal requirements. The processing of filings tends to be delayed for unreasonably long periods of time, thus creating a legitimate demand for the establishment of companies in other countries. Does this legitimize the use of a favorable tax regime abroad? The same goes for regulation. If Slovak or European legislation allow entrepreneurs to do business in certain areas (e.g.: securities trading or collective investment funds) only with regulatory difficulties, entrepreneurs naturally look for more flexible offshore solutions.

Slovakia is a small country, which naturally does not have the expert infrastructure or the ambition to build a full-fledged legislative framework for cryptocurrencies and related business.

The result is an uncertain environment unsuitable for larger projects – owing to the unpredictability of the decision-making of the relevant Slovak authorities. This caused several Slovak cryptocurrency and blockchain projects to consider moving their legal presence abroad. Where this is the case, they are producing offshore companies.

Is it legal?

Can the state interfere with this freedom and force entrepreneurs to tax foreign profits in Slovakia?

The establishment of an offshore company in any tax haven is not inherently illegal. However, its subsequent use may become illegal. Back-to-back fictitious supplies of services from tax havens via the Netherlands or the UK to a Slovak company are still common. The entrepreneur is thus able to shift profits from the 21% tax rate band (Slovakia) to the 0% tax rate band (tax haven).

On the other hand, there are situations where the use of a company based in a 0% tax rate country may be perfectly legal and legitimate. The fact that a country does not tax corporate profits isn´t by itself problematic.

As demonstrated by the Patent Box sub, optimization for IT & development firms, or Super Deduction for R&D, a 0% rate can even be achieved in Slovakia.

To do so, it is necessary to make use of such an offshore company for legitimate reasons (e.g.: PR, investor requirement, more favorable legal environment, etc.).

Slovakia has gradually adopted several legal regulations to discourage Slovak entrepreneurs from the illegitimate use of foreign offshore companies, especially for tax avoidance purposes. These include:

CFC rules for natural persons

These are to ensure that the natural person responsible for a foreign offshore company taxes the company´s profits. For more on this topic, see the video “Is it even worth owning an offshore company nowadays? If so, for whom and when?“. For Peter Varga’s critique of these rules, see My remarks to the Ministry of Finance (CFC rules for natural persons).

CFC rules for legal persons

Many taxpayers are unaware of the existence these rules. They are to ensure that a foreign offshore company´s profits are taxed by the associated Slovak company, provided that the involvement of the foreign offshore company resulted from one or more actions which are not genuine or were taken for the purpose of obtaining a tax advantage.

35% tax rate

Certain cross-border payments made by a Slovak company are subject to a 35% withholding tax rate in Slovakia. On the other hand, certain Slovak recipients´ dividends, liquidation proceeds, or buyouts are subject to a 35% tax rate in Slovakia. This makes it problematic to “just like that” use a company established in the UAE.

Place of effective management (POEM)

By analyzing the company´s POEM, the tax administrator can assign Slovak tax residency to a foreign company even though the company is legally established and existing under another legal system.

Final recipient

When applying withholding taxes, the tax administrator may audit the Slovak taxpayer to see whether he has investigated who the ultimate recipient of the income paid is. The aim is to prevent the use of shell holding companies or other intermediaries.

Transfer pricing

he perception of transfer pricing is underdeveloped in Slovakia. The OECD Transfer Pricing Guidelines envisage its use even in situations where the taxpayer would not ordinarily expect it. These include various internal reorganizations and transfers of activities from one company to another. Such activities should be taxed.

Miscellaneous

In addition to further technical provisions, acts, and judicial practice, there are also substantive policy tools. These are various forms of substantive fairness or abuse of discretion under which a tax administrator may, in certain circumstances, act against a structure that does not formally contradict the wording of the tax regulations.

The analysis of the possible use of an offshore company in a particular setting for a particular client should not only include tax and accounting elements. The structure must be looked at through legal and practical lenses.

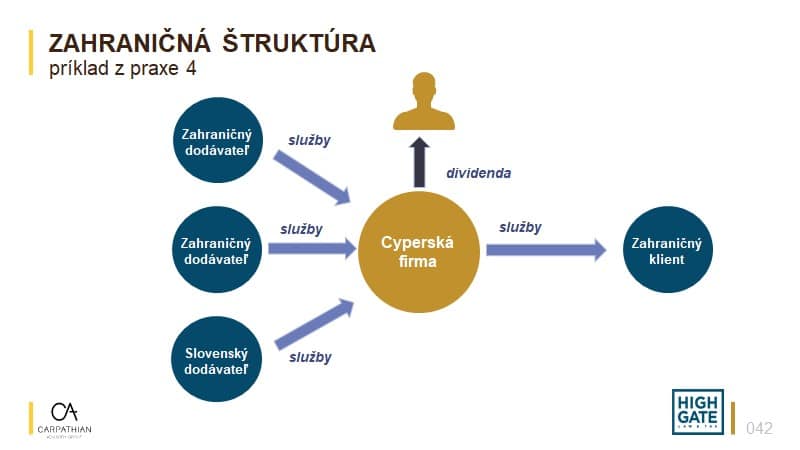

Suppose an entrepreneur wants to take advantage of tax exemption on profits from the sale of stock or a business shares in Cyprus. She does not want to spend on an adequate advisor and makes do with the Internet and her Slovak accountant. She learns on the internet that Cyprus does not tax such profits, finds a company that sets up a Cypriot company and provides a registered office, and her Slovak accountant approves the plan.

Should she involve a competent tax advisor in this structure, she soon learns that there is another dimension to this type of tax optimization. Questions may arise:

- Can the Slovak tax office consider the Cypriot company a Slovak company? How can this risk be eliminated?

- Are the CFC rules for natural and legal persons not applicable to the Cypriot company?

- Are Cypriot company´s profits from any disposition of shares or stock really not taxable? Are there no exemptions?

An attorney sheds light where written law lacks answers. She uses caselaw, analysis of various interpretations of the law (teleological, grammatical, historical, etc.) as well as the philosophy and theory of law to resolve unclear situations. The following topics may be covered:

- If the tax office takes a different view of the entire structure, has the entrepreneur committed tax evasion and insurance fraud?

- If the Cypriot company rents some premises, will this be sufficient "substance" for the purposes of Slovak tax law? Where does this fit within the framework of the EU right of establishment in another EU country?

- Can the sale of a business share through the Cypriot company be considered fraud/ abuse of law?

Relevant practical experience with tax optimization is crucial. It can help with the following:

- How much does it cost to set up and maintain such a company?

- What are the trends and what can be expected in the future?

- Is a company audit mandatory (with the associated considerable increase of the document administration cost)?

- Where is it possible to open a bank account?

- Will banks have a problem with income sourced in Slovakia? What could the consequences be?

- How much does the liquidation of such a company cost?

Our offshore advisory services

A selection of our most popular services:

- analysis of the client's existing structures with respect to the latest tax regulations and anticipated changes;

- analysis of the client's existing structures with respect to criminal liability risks;

- ways to use a foreign offshore company in specific business situations;

- practical advice related to the establishment and use of an offshore company.

An offshore company isn´t just a company incorporated and existing in the jurisdiction of one of the Caribbean islands. Offshore companies can also be Czech holding companies, which until recently were often set up by Slovak tax advisors to avoid capital gains taxation in Slovakia in the event of a successful EXIT. Even the recent sale of a well-known Slovak IT company was executed through an offshore Austrian holding company. An offshore company isn´t just one based in a tax haven and established for the purposes of reducing an entrepreneur’s tax liability.

An offshore company is any company not based in the founder’s domiciled country or the country where the functions and risks associated with the income it generates are carried out and borne. An offshore company may be located in the Czech Republic just as often as in the British Virgin Islands. Offshore companies are also established with a view to achieving a degree of anonymity. It used to be standard practice to hide assets via offshore companies with the legitimate aim of protecting them from various vested interests or violent interests. In South America, Russia, or Ukraine, it is still relatively common for some entrepreneurs to conceal their assets to protect their lives and those of their family members. Slovak entrepreneurs, too, have experience with the dark side of asset transparency, attributable to public access to information on company accounts.

Our clients often seek help with achieving greater anonymity for their assets. There´s a set of reasons – from illegitimate motives associated mainly with criminal activities, to the need to protect the entrepreneur and his family from the attention or unreasonable demands of his business partners or employees. Offshore companies are also set up with the intention of avoiding administrative or regulatory restrictions.

In Slovakia, the business register often does not function in line with legal requirements. The processing of filings tends to be delayed for unreasonably long periods of time, thus creating a legitimate demand for the establishment of companies in other countries. Does this legitimize the use of a favorable tax regime abroad? The same goes for regulation. If Slovak or European legislation allow entrepreneurs to do business in certain areas (e.g.: securities trading or collective investment funds) only with regulatory difficulties, entrepreneurs naturally look for more flexible offshore solutions.

Slovakia is a small country, which naturally does not have the expert infrastructure or the ambition to build a full-fledged legislative framework for cryptocurrencies and related business.

The result is an uncertain environment unsuitable for larger projects – owing to the unpredictability of the decision-making of the relevant Slovak authorities. This caused several Slovak cryptocurrency and blockchain projects to consider moving their legal presence abroad. Where this is the case, they are producing offshore companies.

Is it legal?

Can the state interfere with this freedom and force entrepreneurs to tax foreign profits in Slovakia?

The establishment of an offshore company in any tax haven is not inherently illegal. However, its subsequent use may become illegal. Back-to-back fictitious supplies of services from tax havens via the Netherlands or the UK to a Slovak company are still common. The entrepreneur is thus able to shift profits from the 21% tax rate band (Slovakia) to the 0% tax rate band (tax haven).

On the other hand, there are situations where the use of a company based in a 0% tax rate country may be perfectly legal and legitimate. The fact that a country does not tax corporate profits isn´t by itself problematic.

As demonstrated by the Patent Box sub, optimization for IT & development firms, or Super Deduction for R&D, a 0% rate can even be achieved in Slovakia.

To do so, it is necessary to make use of such an offshore company for legitimate reasons (e.g.: PR, investor requirement, more favorable legal environment, etc.).

Slovakia has gradually adopted several legal regulations to discourage Slovak entrepreneurs from the illegitimate use of foreign offshore companies, especially for tax avoidance purposes. These include:

CFC rules for natural persons

These are to ensure that the natural person responsible for a foreign offshore company taxes the company´s profits. For more on this topic, see the video “Is it even worth owning an offshore company nowadays? If so, for whom and when?“. For Peter Varga’s critique of these rules, see My remarks to the Ministry of Finance (CFC rules for natural persons).

CFC rules for legal persons

Many taxpayers are unaware of the existence these rules. They are to ensure that a foreign offshore company´s profits are taxed by the associated Slovak company, provided that the involvement of the foreign offshore company resulted from one or more actions which are not genuine or were taken for the purpose of obtaining a tax advantage.

35% tax rate

Certain cross-border payments made by a Slovak company are subject to a 35% withholding tax rate in Slovakia. On the other hand, certain Slovak recipients´ dividends, liquidation proceeds, or buyouts are subject to a 35% tax rate in Slovakia. This makes it problematic to “just like that” use a company established in the UAE.

Place of effective management (POEM)

By analyzing the company´s POEM, the tax administrator can assign Slovak tax residency to a foreign company even though the company is legally established and existing under another legal system.

Final recipient

When applying withholding taxes, the tax administrator may audit the Slovak taxpayer to see whether he has investigated who the ultimate recipient of the income paid is. The aim is to prevent the use of shell holding companies or other intermediaries.

Transfer pricing

he perception of transfer pricing is underdeveloped in Slovakia. The OECD Transfer Pricing Guidelines envisage its use even in situations where the taxpayer would not ordinarily expect it. These include various internal reorganizations and transfers of activities from one company to another. Such activities should be taxed.

Miscellaneous

In addition to further technical provisions, acts, and judicial practice, there are also substantive policy tools. These are various forms of substantive fairness or abuse of discretion under which a tax administrator may, in certain circumstances, act against a structure that does not formally contradict the wording of the tax regulations.

The analysis of the possible use of an offshore company in a particular setting for a particular client should not only include tax and accounting elements. The structure must be looked at through legal and practical lenses.

Suppose an entrepreneur wants to take advantage of tax exemption on profits from the sale of stock or a business shares in Cyprus. She does not want to spend on an adequate advisor and makes do with the Internet and her Slovak accountant. She learns on the internet that Cyprus does not tax such profits, finds a company that sets up a Cypriot company and provides a registered office, and her Slovak accountant approves the plan.

Should she involve a competent tax advisor in this structure, she soon learns that there is another dimension to this type of tax optimization. Questions may arise:

- Can the Slovak tax office consider the Cypriot company a Slovak company? How can this risk be eliminated?

- Are the CFC rules for natural and legal persons not applicable to the Cypriot company?

- Are Cypriot company´s profits from any disposition of shares or stock really not taxable? Are there no exemptions?

An attorney sheds light where written law lacks answers. She uses caselaw, analysis of various interpretations of the law (teleological, grammatical, historical, etc.) as well as the philosophy and theory of law to resolve unclear situations. The following topics may be covered:

- If the tax office takes a different view of the entire structure, has the entrepreneur committed tax evasion and insurance fraud?

- If the Cypriot company rents some premises, will this be sufficient "substance" for the purposes of Slovak tax law? Where does this fit within the framework of the EU right of establishment in another EU country?

- Can the sale of a business share through the Cypriot company be considered fraud/ abuse of law?

Relevant practical experience with tax optimization is crucial. It can help with the following:

- How much does it cost to set up and maintain such a company?

- What are the trends and what can be expected in the future?

- Is a company audit mandatory (with the associated considerable increase of the document administration cost)?

- Where is it possible to open a bank account?

- Will banks have a problem with income sourced in Slovakia? What could the consequences be?

- How much does the liquidation of such a company cost?

Taxes and criminal liability

Under Slovak tax law, not every illegal tax optimization qualifies as a tax offence. As with the identification of what is and what is not lawful in minimizing tax or contribution liability, the line between criminal and administrative law (Tax Optimization – Domestic and Foreign Options) in regards to tax offences is vague.

Text from the slide:

Unfortunately, Slovak tax law does not have extensive clarifying case law, where courts or prosecutors might focus on delineating more precise boundaries. From a business point of view, it is not at all comfortable to be unable to foresee the penalty for a tax offence committed. In this context, imprisonment (in conjunction with the penalty of asset forfeiture) is indeed the most serious potential personal risk.

A majority of Slovak entrepreneurs can relate to the case of Andrej Kiska’s KTAG. From the rule of law perspective, it is unproblematic that the he was charged with tax evasion and insurance fraud. Rather more troubling is that previous tax administrators and law enforcement authorities had never before indicated the accused conduct exceeded the criminal threshold. This second point impacts a huge number of entrepreneurs who potentially may be exposed to the prospective arbitrariness of the State which seeks to criminalize heretofore acceptable conduct.

Our services

We provide comprehensive services in the field of tax consulting and tax optimization (Tax optimization – Domestic and Foreign Options). In addition to technical advice, this also includes legal analysis with an emphasis on analysis of likely criminal risks.

Clients typically use our services in the following situations:

- transactional advice, which also includes tax advice;

- when assessing an existing tax and legal structure;

- when setting up a client's business with an emphasis on tax – contribution efficiency;

- when representing a client before the tax authorities or courts.

Practical examples – Case studies

Case 1: A company makes a profit. However, it does not pay the profit to the shareholder as a dividend, but instead gifts it to the shareholder, thus avoiding dividend taxation. Slovak legislation does not formally prohibit this. It can be regarded as:

- legal tax optimization (avoiding taxes on dividends);

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 2: A well-known athlete moves to Monaco and becomes a Monegasque tax resident. However, he spends a large part of the year in Slovakia at various marketing events, staying over in his Bratislava apartment or hotels. If he does not tax his worldwide income in Slovakia, it is:

- legal tax optimization (avoiding Slovak taxes);

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 3: An entrepreneur purchased a family car from which she deducted 100 % VAT and treats 100 % of the car depreciation as a taxable expense. However, she uses the vehicle exclusively for family transfers. This is:

- legal tax optimization;

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 4: An entrepreneur owns two companies. Before the end of the calendar year, the preliminary results showed that one company was expected to make a profit of €1 000 and the other a loss of €500. Therefore, the entrepreneur decides to invoice €400 from the loss-making company to the profitable company for marketing services, thus reducing tax liability. This is:

- legal tax optimization;

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

Case 5: An entrepreneur set up a company on a Caribbean Island with a 0% tax rate, and from which she invoices her IT services to Slovak clients. However, the entrepreneur is mainly based in Slovakia when performing the services. This is:

- legal tax optimization;

- illegal tax optimization, the only penalty being a tax and a fine;

- illegal tax optimization, which is also the criminal offences of tax evasion and insurance fraud.

What is the Super Deduction and how does it work?

Suppose a taxpayer spends the following amounts on R&D activities:

- 10 000 EUR in 2019

- 50 000 EUR in 2020

- 100 000 EUR in 2021

The Income Tax Act allows the taxpayer to reduce his tax base in his 2021 tax return by:

- 200 % of the amount spent on R&D in 2021

- 100% of the "increase" in the cost of R&D activities in 2019-2021

The total amount of the super deduction that reduces the taxpayer’s tax base is 245 000 EUR.

The taxpayer can save 51 450 EUR on income tax that year.

By means of the Super Deduction, the taxpayer can achieve an effective tax rate of 0% when combined with the Patent Box. Thus, the effective tax rate may be less than 5%.

An IT company carries out an experimental development that, once completed, generates licensing income. Assume the firm registers revenues and costs as shown in the following table (in EUR):

| YEAR | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|---|

| Licensing revenue | 0 | 0 | 200 000 | 500 000 | 750 000 | 1 000 000 | 1 200 000 |

| Relevant R&D costs | 250 000 | 250 000 | 0 | 0 | 0 | 0 | 0 |

| Depreciation | 0 | 0 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 |

| Other costs | 25 000 | 50 000 | 75 000 | 100 000 | 125 000 | 150 000 | 175 000 |

| Profit | 25 000 (strata) | 50 000 (strata) | 25 000 | 300 000 | 525 000 | 850 000 | 925 000 |

| Super Deduction | 625 000 | 625 000 | 12 500 | 150 000 | 262 500 | 425 000 | 400 000 |

| Tax | 0 | 0 | 0 | 0 | 0 | 0 | 13 125 |

| Effective tax rate | 0 % | 0 % | 0 % | 0 % | 0 % | 0 % | 1,4 % |

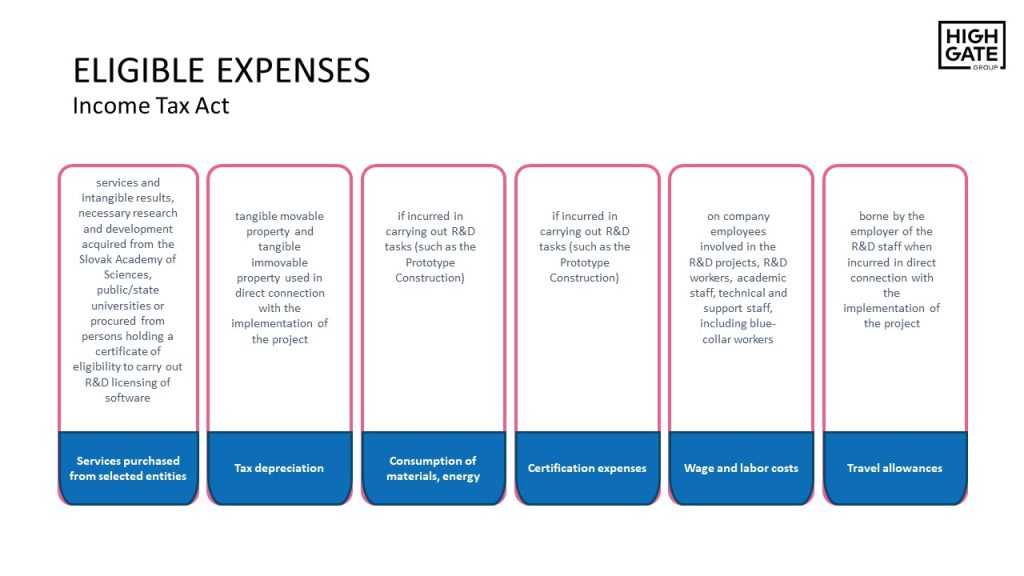

To qualify for the Super Deduction, a taxpayer must be performing one of the following R&D activities:

- Basic research: Theoretical or experimental research, carried out for the purpose of acquiring new knowledge of fundamental principles or phenomena, not primarily aimed at the application of practical results. It is research without a specific purpose for a final product.

- Applied research: theoretical or experimental research aimed at acquiring new knowledge. This research is primarily designed to achieve a specific result. It is carried out to confirm a hypothesis (e.g.: product characteristics).

- Experimental development: Systematic investigation that combines, shapes, and uses existing knowledge from research and business practice to design a new or sustainably improved product, process, or service. This is very common in software companies.

For a taxpayer´s R&D activity to meet the criteria, it must have the following features:

- Novelty - The search for undiscovered structures or relationships, the application of knowledge or techniques in a novel way, an element of novelty (within the scope of information that may be available at the time).

- Creativity - New concepts, not routine tasks or changes and routine activities. The project uses new methods to perform routine tasks.

- Uncertainty - Uncertainty in achieving results, uncertainty in cost or timing. Project objectives are set before the implementation stage (objectives achievability, measuring outcomes). The actual achievement of the objectives.

- Systematicity - Investigating phenomena and processes according to a definite, theoretical, and practically justifiable plan, deliberately, purposefully without improvising and not randomly. Project phasing, milestones, decision making, staffing matrix of R&D activities, staff qualifications and positions.

- Transferability - Transferability of new knowledge, new, deeper understanding of phenomena, relationships, principles with broader relevance, expected benefit, i.e., patent, license, protected design, etc., linkage to the larger whole (e.g., to other activities of the enterprise).

As legal and economic advisors, we cannot assess whether an activity qualifies as R&D activity. Nor should the assessment be left to the client.

We cooperate with the Czech company RESEA that specializes exclusively in R&D activities. They assess whether the case is indeed an R&D activity and prepare the necessary technical documentation.

Slovak tax offices have minimum experience with Super Deductions. They therefore cooperate with the Czech Financial Administration, which has considerably more experience in tax audits and proceedings.

When preparing a taxpayer for possible tax audit, it is essential to anticipate and already set up documentation and processes in line with the existing Czech practice at the Super Deduction implementation stage. Our partner RESEA has 15 years of experience in the field.

Be aware that under the Tax Code, the taxpayer is at a disadvantage from a procedural perspective in the first phase. Should the tax administrator raise doubts about the legality of the Super Deduction application, the burden of proof is on the taxpayer to support their tax return claims.

We represent clients in tax proceedings, from tax audits to court proceedings where legal representation is required.

By working with us on Super Deduction, the client receives a comprehensive service from analysis, to set-up, to tax calculation, to eventual representation at the European Court of Human Rights.

Complexity:

- By working with us on Super Deduction, the client receives a comprehensive service from analysis, to set-up, to tax calculation, to eventual representation in court where legal representation is required.

Technical documentation:

- We provide complete formal and technical Super Deduction documentation. Technical documentation must be both transparent and technically robust. This is because the documentation needs to be written with a view to being reviewed by the tax office. Thanks to our experience with Czech tax audits, we know how to make it defensible, too.

Large team:

- In cooperation with our Czech partner RESEA, we have more than 10 years of Super Deduction experience. We have accumulated vast experience in the technical, science, and IT fields. The team of technical experts helps the client navigate the defensibility of R&D activities.

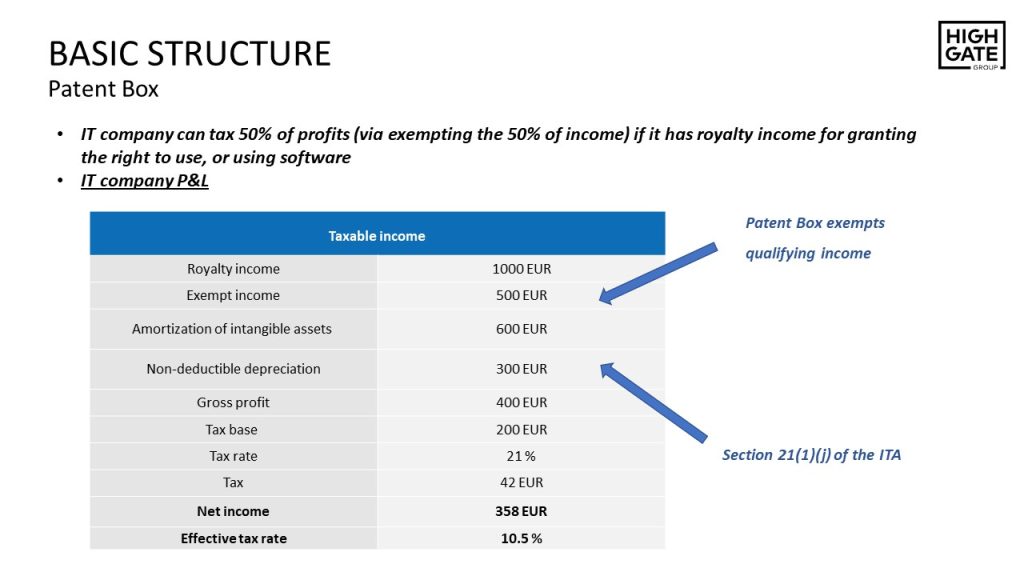

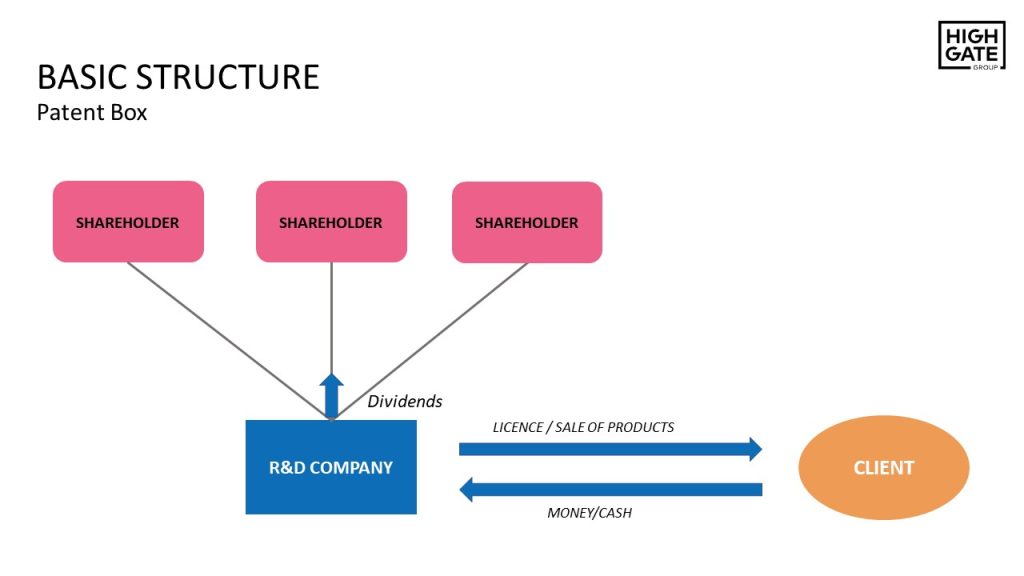

What is a Patent Box

Thanks to the Patent Box, software-developing IT companies and other technical solutions developing R&D companies pay 10.5% income tax in Slovakia. To pay lower taxes, there´s no need for a Slovak IT company to come up with complex and administratively demanding cross-border solutions.

In his article “Slovakia can be a tax haven too!” Peter Varga acknowledged Slovakia’s efforts (i.e., Patent Box) to level up with other preferential tax regimes in Europe. The Patent Box is a powerful legal and legitimate tax optimization tool, particularly for Slovak IT companies. Although relatively late, Slovakia got inspired by other European IP Box regimes that help countries attract added value to their territories.

The Patent Box exempts from income tax up to 50% of the taxpayer´s royalty income for granting the right to use, or using:

- a patent-protected invention or a utility model-protected technical solution resulting from the taxpayer´s R&D;

- software resulting from the taxpayer´s vývoja R&D.

The Patent Box also offers this tax exemption to taxpayers who derive income from the sale of products manufactured in whole or part using the patent-protected invention, or a utility model-protected technical solution resulting from the taxpayer´s R&D activities.

The Patent Box is a new instrument supporting R&D in Slovakia. It makes it possible to exempt from corporate income tax up to 50% of revenues from the provision of intangible assets (licensing revenues) and revenues from the sale of products manufactured using the patent or utility model. If a Slovak company does its accounting correctly and fulfils other conditions, it may benefit from the reduced income tax rate of 10.5% instead of the standard 21%.

The Patent Box exempts from income tax up to 50% of the taxpayer´s royalty income for granting a right to use, or for using:

- a patent-protected invention, or a utility model-protected technical solution resulting from the taxpayer´s R&D;

- software , resulting from the taxpayer´s R&D;

The Patent Box also offers this tax exemption to taxpayers who derive income from the sale of products manufactured in whole or part using the patent-protected invention, or a utility model-protected technical solution resulting from the taxpayer´s R&D activities.

The Patent Box can help the taxpayer achieve an effective tax rate of 10.5%. We help clients combine the Patent Box with the R&D Super Deduction, potentially achieving an effective tax rate of 0% for several years.

Say an IT company carries out an experimental development that, once completed, generates licensing income. Assume the firm registers revenues and costs as shown in the following table (in EUR):

| YEAR | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|---|

| Licensing revenue | 0 | 0 | 200 000 | 500 000 | 750 000 | 1 000 000 | 1 200 000 |

| Relevant R&D cost | 250 000 | 250 000 | 0 | 0 | 0 | 0 | 0 |

| Depreciation | 0 | 0 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 |

| Other costs | 25 000 | 50 000 | 75 000 | 100 000 | 125 000 | 150 000 | 175 000 |

| Profit | 25 000 (strata) | 50 000 (strata) | 25 000 | 300 000 | 525 000 | 850 000 | 925 000 |

| Super Deduction | 625 000 | 625 000 | 12 500 | 150 000 | 262 500 | 425 000 | 400 000 |

| Tax | 0 | 0 | 0 | 0 | 0 | 0 | 13 125 |

| Effective tax rate | 0 % | 0 % | 0 % | 0 % | 0 % | 0 % | 1,4 % |

The key prerequisite is the carrying out and correctly accounting for R&D activities. Accounting audits of young IT companies reveal many companies incorrectly accounting for software development. By doing so they are committing offences under the Accounting Act, potentially subjecting them to a fine up to 2% of their assets´ value. Furthermore, incorrect accounting may unjustifiably reduce the entrepreneur’s tax liability and disqualify them from using the Patent Box.

It is essential that the Patent Box accounting is done correctly, and its use is anticipated in advance. Moreover, the Patent Box provisions indicate a requirement that taxpayers use their own research and/or development output. The Patent Box requires that only employees of the taxpayer be part of the personnel producing the intangible R&D output.

Due to the high tax and contribution burden on labor, taxpayers find using contractors (trade license, single-member LLC) more economically viable. In certain circumstances and with well-drafted contracts protecting the IP and other intangible results, the employee requirement can be omitted. Excluding a Patent Box-experienced attorney can adversely impact a taxpayer’s use of the regime.

The Patent Box is an institution – its statutory application affects tax, accounting, and intellectual property law alike.

This is a very intricate subject from both legal and tax accounting perspectives. Peter Varga discussed the topic in detail at the methodological days of the Slovak Chamber of Tax Advisors. He and the Ministry of Finance representative co-lectured on the Patent Box, including the topic of use of an external workforce (trade license or trading companies). A company can, in certain circumstances, use external workforce without reducing the Patent Box tax relief. It just requires some factual and legal adjusting.

We address the topic frequently. We publish articles and give commercial or methodological lectures on the topic. Find more information in our articles, press releases, videos, or conferences.

In cooperation with our lawyers, we provide the following Patent Box services:

- bookkeeping and accounting advice;

- tax calculation analysis & preparation of relevant Patent Box accounting documentation;

- contract drafting/amendment of existing contracts to benefit from Patent Box and IP protection;

- Patent Box-related transactional advice;

- representation of the client before the tax authorities and courts;

- technical audit of the taxpayer's R&D activities to determine whether they qualify as R&D (in cooperation with the Czech tech company RESEA).

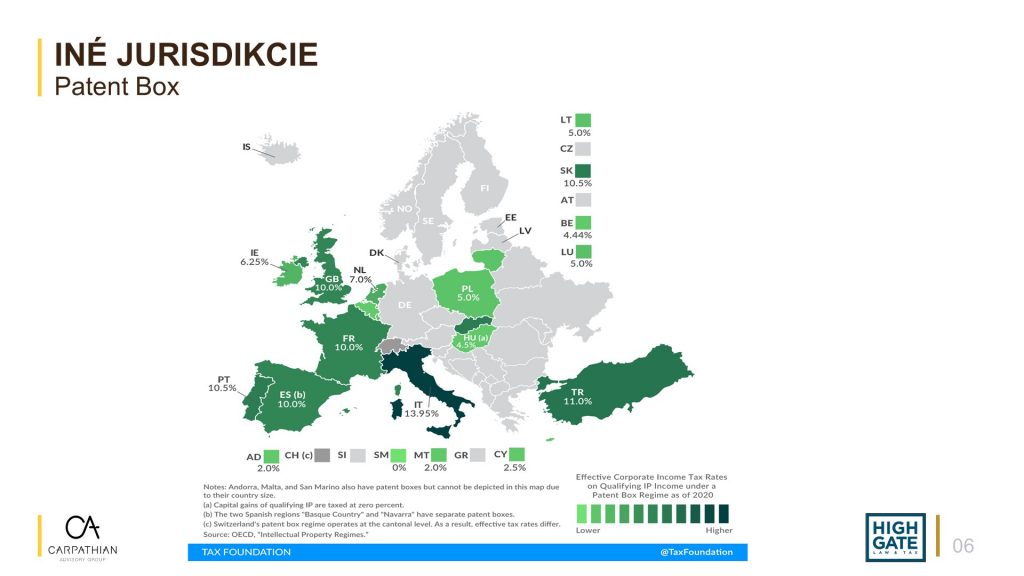

The origins of the Patent Box date back to the 1970s Ireland. Legislation at the time allowed companies licensing certain forms of intellectual property to reduce their income tax. The concept was gradually replicated by other countries, including France, Luxembourg, Cyprus, and the UK. More recently, it has been common to set up an offshore company in Cyprus and benefit from the reduced tax rate of 2.5% on income from the IP use when invoicing within the group.

The Patent Box concept is very popular nowadays. Its nexus approach prevents tax abusive practices. As the figure shows, Slovakia ranks among the more progressive countries in this respect.

We have worked on a number of “blockchain based” projects. These include:

- establishment of investment funds investing in cryptocurrencies;

- establishment of a decentralized exchange;

- regular savings through cryptocurrencies;

- cryptocurrency management service documentation preparation;

- tax advice and tax optimization for cryptocurrency taxation;

- security token offering;

- utility token offering;

- accounting.

For more information on our cryptocurrency practice, visit the Highgate Group website. Programmers´ R&D activities in the field of blockchain may qualify for the Patent Box regime, too.

Crypto cannot be viewed in isolation – it must be assigned the corresponding legal and tax frameworks.

The Patent Box or the R&D Super Deduction are examples of such frameworks.

OUR COURSES AND TRAINING

- How can I (efficiently) tax income from securities, derivatives, or cryptocurrencies? Can I avoid taxation altogether?

- Want to get paid through the company, legally and tax-efficiently, as a partner? There are multiple options.

- Is it better to buy an apartment/chalet/securities as a natural or legal person?

- Is a trade license or LLC better for me? What about social insurance contributions? Can I, as a self-employed person, invoice my own company?

- Scaling business abroad, using offshore companies. Can I pay 0% tax abroad?

- How can I prepare a company for a sale or investor entry?

- What are the available and effective options for external Company financing?

- How can I negotiate a good term sheet with an investor?

- What should I watch out for when preparing a shareholders' agreement?

- What are the shareholder dispute resolution options?

- What are the options and advantages of different forms of employee stocks and shares (ESOPs)?

Law & Tax

Tomáš Demo

tomas.demo@highgate.sk

Accounting

Peter Šopinec

peter.sopinec@highgate.sk

Crypto

Peter Varga

peter.varga@highgate.sk